*Editor's Note: This article was originally published March 25 and updated April 8 with new information.

Steady growth is expected to define the hydraulics, pneumatics and overall fluid power industry for the next few years. Several factors will help keep demand for components high, including continued growth in heavy equipment markets such as construction and mining, as well as strength in the manufacturing sector.

Despite supply chain challenges, demand remains strong for products in a variety of industries requiring the use of fluid power components which will benefit the market.

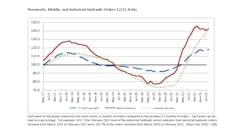

The National Fluid Power Association’s (NFPA) latest Fluid Power Industry Growth Trend report shows there has been steady growth for hydraulics, pneumatics, and total fluid power components since February 2021. Year-to-date percent change for total fluid power shipments in February 2022 was 18.8%, states NFPA in its report.

The association also notes mobile hydraulic component orders received from March 2021 to February 2022 were 142.5% of those received during the previous period (March 2020 to February 2021). NFPA says pneumatic shipments stayed the same as the previous month while both industrial and mobile hydraulic shipments were up.

A forthcoming report from Interact Analysis indicates mobile hydraulics—which account for close to 60% of the total hydraulics market—will be the key driver for the hydraulics market going forward. Electrification is a key driver for this, states Brianna Jackson, research analyst at Interact Analysis, and contributor to the upcoming report.

As OEMs move to electric powered machines, they will need to improve the efficiency of other components and systems such as hydraulics, which could provide many opportunities for manufacturers.

Jackson predicts in 2022, supply chains will pose some challenges to the industry though not necessarily to the extent other industries are facing. She also foresees a strong outlook over the next five years for mobile hydraulics. Though some predict a displacement of this technology, that is not likely to be the case, as hydraulics still offer the power density needed in many applications as well as cost efficiency.

Hydraulic Cylinder Market to Grow Through 2027

Research firm MarketsandMarkets’ latest report on the hydraulic cylinder market projects it will reach a value of $18.3 billion by 2027, achieving a compound annual growth rate (CAGR) of 4.4% from 2022-2027. MarketsandMarkets says the growth will mostly be attributed to increased demand in construction and mining equipment used in the construction, mining and oil & gas industries.

The research firm notes increased adoption of material handling equipment—much of which utilizes hydraulic cylinders—in various global industries will help boost growth for the market.

Double-acting hydraulic cylinders are expected to account for a larger share of the market during the forecast period, says MarketsandMarkets. These cylinders’ retraction properties benefit a variety of industries including aerospace, automotive and agriculture, and tend to be in high demand for mobile applications such as earth moving equipment, forklifts and heavy trucks. All of these segments are anticipated to see growth in the coming years, aiding market conditions for double-acting hydraulic cylinders.

Welded hydraulic cylinders are also forecast to make up a large part of the market and its growth. According to MarketsandMarkets, these cylinders accounted for the largest share of the hydraulic cylinder market in 2021. They are commonly used in mobile applications such as construction, mining, and material handling equipment which have all seen a high level of growth over the past year, leading to growth for the hydraulic cylinders as well.

Per MarketsandMarkets, the agriculture industry is expected to grow at the highest CAGR during the forecast period due in large part to increasing mechanization around the world. And because hydraulic cylinders are utilized in almost all types of agriculture equipment, the market will benefit from the growth anticipated in this machinery segment.

Of the various hydraulic cylinder types, MarketandMarkets’ research shows those with a bore size ranging from 50-150 mm (2-6 in.) comprised the majority of the market in 2021. This size range is forecast to continue dominating much of the market because of the wide range of applications in which it can be used, including construction and agriculture equipment.

Asia-Pacific (APAC) accounted for the largest share of hydraulic cylinder demand in 2021, and is expected to have the highest CAGR for this market through 2027. Increased demand for hydraulic cylinders is due to growing demand in the region for agricultural, construction and mining equipment. There is a growing population and desire for more industrialization, necessitating use of these machines.

MarketsandMarkets says Japan and Australia are the major markets for hydraulic cylinders in APAC. Japan has several automotive manufacturers and suppliers who require the use of hydraulic cylinders, even as they begin to automate more of their manufacturing operations. Meanwhile, Australia is home to several mine sites which use hydraulic cylinders in their equipment. The growing need for minerals and other materials for various products around the world such as batteries will continue to drive the mining market and thus the need for hydraulic cylinders.

Manufacturing, Oil & Gas will Provide Gains for Pneumatic Cylinder Market

A report from Allied Market Research released in late 2021 on trends in the global pneumatic cylinder market indicate this segment will see a CAGR of 5.8% through 2030. The market is expected to generate $23.85 billion in revenue.

Growth will be driven by increased demand from the manufacturing sector, rising use in the automobile and aerospace industries, as well as increasing construction activities states Allied Market Research. The research firm says increased automation and advancements in space technology will provide new opportunities for the pneumatic cylinder market in the coming years.

According to the report, linear products are projected to achieve the highest CAGR at 6.0% through 2030, while the rotary segment will achieve 5.5% CAGR. Linear components accounted for over half of the global pneumatic cylinder market in 2020; this market strength will continue through the forecast period due to availability of products which meet new industry demands.

The largest end use segment for pneumatic cylinders in 2020 was the oil & gas industry, says Allied Market Research. It projects this segment will continue to be the largest market driver for these components due to a rise in population and industrialization—and therefore increased need for oil and gas products.

Automotive is also expected to account for a large share of the market, with a CAGR of 9.2% projected through 2030. Allied Market Research says this is because of the growing demand for economical and efficient manufacturing which has increased use of robotic automation.

North America is projected to continue being the dominant market for pneumatic cylinders as the oil & gas industries in the U.S. and Canada are fueling demand for these products. Asia-Pacific will achieve the fastest CAGR of 7.0% due to its large population and low-cost manufacturing sector says the research firm.

Heavy Equipment Sectors to Help Drive Growth

Among the key drivers for continued positivity in the fluid power industry is strong demand for heavy-duty off-road equipment such as construction machinery. President Biden’s infrastructure bill has aided this market as well as infrastructure investments taking place around the world.

According to a new study from Grand View Research Inc., the global construction equipment market will achieve a CAGR of 3.9% through 2030. It is projected to reach a value of $161.99 billion. Modernization efforts and global infrastructure investments are key drivers for this market growth.

Hydraulics are a key component in several types of construction equipment. As such, growth in this machinery market will greatly benefit hydraulic component manufacturers.

Grand View Research reports material handling machinery will exceed a 4% CAGR during the forecast period due to increased demand for crawler cranes, which offer more convenience and accessibility on smaller job sites. Concrete and road construction machinery is expected to reach a 5% CAGR as investments in highway projects increase.

The Association of Equipment Manufacturers (AEM) reports in its Ag and Construction Equipment Market Outlook released Feb. 21 that the value of the construction industry is projected to grow 4.5% in 2022. It will be driven in large part by the residential construction segment, which benefited during the COVID-19 pandemic when more people were buying homes and making improvements on their existing domiciles.

AEM says insights provided by its members indicate strong demand in the construction equipment sector will continue, with 83% saying year-over-year growth is likely going forward. Over the next 12 months there is the potential for 6-10% growth, which will be 6-10% higher than what was anticipated in 2021.

Likewise, the agricultural equipment market—also a strong user of hydraulic components—is expected to remain positive. AEM says farmer income has increased, enabling money to be spent on new equipment. Members of AEM expect equipment demand will stay strong in this sector as well; 81% of members surveyed by the association foresee year-over-year growth in the near-term, while 91% are expecting continued growth. However, inventories are low after being depleted in 2021, says AEM, which could pose challenging for OEMs needing to keep up with the high level of demand.

In AEM’s March 10 U.S. and Canada agriculture report, Curt Blades, senior vice president, Industry Sectors & Product Leadership at AEM, says continued strength in the commodities market will aid farm equipment sales, particularly larger row crop units. The rise in fuel prices will also likely drive farmers to purchase more efficient models to help curb fuel costs.

In its Ag and Construction Equipment Market Outlook, AEM notes the global economy is forecast to remain on track for expansion in 2022, with growth of 3.9% projected for the year. This will be a slight decline from 2021 which saw 5.1% growth; overall 2022 is expected to be a year of slow growth.

Despite the projected positivity in the market, AEM notes surveys of its members show there are some market factors which could pose challenges for equipment and component manufacturers. Supply chains, the ongoing COVID-19 pandemic and labor shortages are some of the short-term factors, while deglobalization and inflation are long-term aspects which could all impact manufacturers and the global economy.

Manufacturers Report Strong Financials

Further solidifying the positive market conditions for hydraulic and pneumatic components, several manufacturers have reported positive sales in 2021 and expectations for continued positivity in 2022.

Danfoss, for instance, recently released its annual report for 2021 which showed a 29% increase in sales during the year. This was achieved through 18% year-over-year organic growth as well as the addition of Eaton’s hydraulics business.

The company says it delivered growth in all regions while also increasing investment in R&D 23%. In addition, Danfoss says there was strong demand for its energy-efficient products which helped lead to a rise in sales for 2021.

“We have never seen better opportunities for Danfoss. It is our ambition to be the leading technology partner for our customers in the green transition—decarbonizing through energy efficiency, low emissions and electrification,” says Kim Fausing, president & CEO of Danfoss, in the company’s press release announcing its 2021 financial results. “After all, the greenest energy is the energy that we don’t use. Our momentum is clearly reflected in our 2021 annual results. Danfoss has delivered the best results in our history, and we are in a strong financial position.”

The company is predicting a positive market outlook for 2022 and expects to expand or maintain its current market share. This outlook includes a full year of ownership of Eaton’s hydraulics business, the company says. It expects sales to be in the range of €8.8-9.8 billion for fully-year 2022. However, this growth will of course be dependent upon global supply chain disruptions—which could be further hindered by the current conflict between the Ukraine and Russia—as well as the pandemic and the global economy in general.

Parker Hannifin Corp.’s fiscal 2022 second quarter (ended Dec. 31, 2021) results reached a second-quarter record of $3.82 billion according to the company. This was a 12% increase compared to the same quarter for fiscal year 2021.

“Our teams executed extremely well in the second quarter in an environment of strong demand against a backdrop of inflationary pressures and supply chain challenges together with disruptions brought on by the ongoing COVID-19 pandemic,” said Chairman and Chief Executive Officer Tom Williams in the company’s press release announcing its second quarter 2022 results.

For its Diversified Industrial Segment, Parker reports sales rose 15% in North America while international sales increased 11%. The Aerospace Systems Segment also saw an increase of 6%.

Total orders increased 12% during the quarter. The Diversified Industrial North America businesses reported a 17% increase in orders and 14% increase for International businesses. Orders decreased 7% in the Aerospace Systems Segment.

For the full 2022 fiscal year, which ends June 30, 2022, Parker has increased its guidance for earnings per share. The company predicts there will be organic sales growth of approximately 10-12% compared to 2021 as positive demand trends are anticipated to continue.