Mobile Hydraulics Market Rebound in 2021 Leads to Positive Future

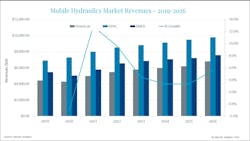

After contracting slightly in 2020, the global mobile hydraulics market recovered in 2021, reaching a value of $18.7 billion reports research firm Interact Analysis. The market achieved a compound annual growth rate (CAGR) of 5.2% between 2019 and 2021. Further growth is anticipated in 2022 and beyond.

Interact Analysis’ latest report on the mobile hydraulics market, released in the spring of 2022, shows a boom in the material handling sector—due to the increase in ecommerce and general economic activity—was the strongest driver for the mobile hydraulics market’s recovery. Increased demand for construction equipment benefited the market as well.

Rebound of Global Economy Benefits Hydraulics

In 2020, the mobile hydraulics market in EMEA (Europe, the Middle East and Africa) contracted 9.7% and the Americas 3.2% due to economic downturns caused by the COVID-19 pandemic. During this time EMEA’s share of agricultural machinery production declined as well, but the boom in the material handling sector in that region is benefiting the hydraulics market.

“EMEA’s declining share of the agricultural machinery market is not due to a decline in machinery production in EMEA, but rather the rapid growth of agricultural machinery production in APAC (Asia-Pacific),” said Brianna Jackson, research analyst at Interact Analysis, in an interview with Power & Motion. “Within APAC, the agricultural industry is being increasingly mechanized to boost crop production to support a larger and consistently growing population.”

According to the report, APAC has shown impressive growth over the past 20 years and accounted for 50% of the mobile hydraulics market in 2020. Growth in this market is expected to stabilize as it matures, reports Interact Analysis. APAC is expected to remain in positive territory in 2022, but growth will decelerate as the construction sector in this region begins to slow down.

“Over the past two decades, APAC as a region was able to establish itself as a manufacturing powerhouse as manufacturing operations from Europe and America were offshored in efforts to reduce production costs,” said Jackson. “The growth of APAC-based vehicle OEMs has also boosted the demand for hydraulics within the region. Additionally, APAC-based vehicle OEMs have increasingly shifted away from sourcing components from foreign companies giving boon to domestic suppliers.”

Interact Analysis’ report shows EMEA and the Americas both rebounded in 2021 from the contractions seen in 2020. The research firm expects this rebound to continue into 2022 as order backlogs are met.

Research conducted for the report indicates growth in the Americas will increase exponentially as major infrastructure projects go into effect around 2026 due in large part to the infrastructure bill passed by U.S. President Biden in 2021.

Key Sectors Driving Growth for Mobile Hydraulics

Heavy-duty mobile equipment applications such as construction, agriculture and material handling are strong market segments for hydraulics. Even with increasing electrification in these and other markets, hydraulic components will remain vital because of the force they can provide which is necessary in these heavier-duty applications.

In its report on the mobile hydraulics market, Interact Analysis outlines how these segments performed in 2021 and expected performance in the coming years.

Material Handling

According to Interact Analysis, the material handling market will see strong growth through 2026. This sector accounted for 25% of the market in 2020 and is expected to increase its share to 28.8%. Material handling is forecast to experience a CAGR of 8%, outpacing the growth of the overall market which is set to achieve a CAGR of 5.3%, reports Interact Analysis.

Jackson said the rapid rise of e-commerce is a key driver for the growth of the material handling market in EMEA. This in turn has increased its role as a user of hydraulic components, benefiting manufacturers and suppliers in that region.

Forklifts account for the majority of vehicles produced and sold in this sector, she said. “As a result of the rapid growth of e-commerce, the warehouse and logistics sector has exploded. Traditionally forklifts are a vehicle more heavily used in manufacturing, but as e-commerce has increased the number and square footage of warehouses, more forklifts are being used in the warehouse and logistics sector.”

In November 2021, Interact Analysis released updated data on the global forklift market corroborating Jackson’s analysis. The research firm foresees a positive long-term outlook for the market driven in large part by e-commerce, electrification and digitization.

Forklifts make it easier to move more material and goods, helping to improve the productivity and efficiency of operations. They are also seen as easier applications to apply electrification and automation technology, which will help further enhance productivity and efficiency.

These vehicles are also a key user of hydraulic components; their continued market growth will therefore benefit the mobile hydraulics industry.

Construction

Infrastructure projects around the world have helped keep demand for construction equipment strong. Investments in infrastructure, like the U.S. infrastructure bill, are expected to continue at a positive rate in much of the world. This will benefit the mobile hydraulics market as construction equipment is one of the top industry sectors in which hydraulic components and systems are utilized.

In a press release from May 19, 2022, the Association of Equipment Manufacturers (AEM) said its members are reporting every construction equipment category remains strong. There are increases across the board for all products in 2022 compared to 2021, stated AEM in the release. It also noted the 12-month outlook appears positive with a slight decline expected for total heavy/light equipment.

The association also reported in December 2021 that its members anticipated rising demand for construction equipment in 2022; at that time 44% said they anticipated demand to be above normal.

Europe’s construction industry association CECE (Committee for European Construction Equipment) takes a monthly barometer of the industry based on input from those in the sector. Its most recent in May showed industry sentiment remains high, although its business climate index continued a modest decline.

Like many industries, those in the European construction equipment market are concerned about supply chains and input costs which have posed challenging for manufacturers of all types. CECE reports the industry sees North America as the most promising market followed by Germany, France, Italy and the CEE markets (EU member states part of the former Eastern bloc) in Europe.

Although the construction equipment sector has been strong in APAC due to rapid expansion of construction projects led by China, Jackson said deceleration—also led by China—is likely in the near future.

“Currently, China makes up around half the global construction sector within the mobile hydraulics market. As an industry, the construction sector is integral to the Chinese economy. The construction sector has historically been upheld by governmental investment in infrastructure as well as an investor-friendly lending environment,” she explained. “However, going forward as lending standards have tightened and demand for real estate has also taken a dive, construction starts have slowed which will likely cool down growth for the construction sector within the mobile hydraulics market.”

Agriculture

Agricultural machinery is another strong market for hydraulics. The sector saw positive activity in recent years in many regions of the world due to the need to continue providing food for a growing global population. Many regions of the world are also increasing their use of machines in place of human labor, further benefiting demand for agricultural equipment.

In AEM’s December press release reviewing the heavy equipment outlook for 2022, 65% of respondents to its fall member survey indicated they thought demand for agricultural equipment would be above normal levels.

While 2022 started positively for the market, supply chain challenges are having a negative impact. AEM’s most recent tractor and combine report shows U.S. tractor and combine monthly unit sales declined in May, although sales in Canada remained in positive territory. Total farm tractor sales in the U.S. declined 14.5% and combine sales were down 12.7%. The only sector of the market with positive sales in May were for two-wheel drive 100+ hp machines, which grew 13.9%.

According to Curt Blades, senior vice president, industry sectors & product leadership at AEM, supply chains are the primary challenge for the agricultural equipment market at the moment. He also noted in AEM’s press release announcing its May agriculture machinery figures that 2021 sales were well above historic trends, which should be kept in mind when looking at 2022 figures.Despite the most recent declines seen in the U.S. and EMEA’s previously noted reduced share in agricultural machinery production, overall this segment is expected to remain a key sector for the mobile hydraulics market, as there will continue to be demand for this equipment to help feed the world.

Current and Future Market Outlook

In general, the mobile hydraulics market is performing well and is expected to continue doing so even if at a slower growth rate. After the speed at which the global economy recovered in the second half of 2020 and throughout 2021, many experts believe market conditions will remain positive, but growth rates will slow. This is the case for mobile hydraulics as well as the markets it serves.

In the National Fluid Power Association’s (NFPA) most recent fluid power market data released in early June, growth trends continued although a shift to a slowing growth rate began in April 2022. Shipments for mobile hydraulic components declined in April compared to the previous month reported NFPA.

As with the many industries it serves, the mobile hydraulics market is also being impacted by supply chain challenges, geopolitical issues—such as the conflict between Ukraine and Russia—as well as inflation and other market factors.

Jackson said extended lead times, sky-rocketing raw material prices and a skilled labor shortage are among the supply chain factors negatively impacting the mobile hydraulics market. “Lead times are up across the board for most vendors, with lead times past 52 weeks in some cases as many vendors continue to deliver orders that were placed over a year ago,” she said. “Many of the vendors we spoke to [for the report] initially expressed that they expected supply chain issues to resolve in the latter half of 2022/early 2023.

“Sky-rocketing raw material prices as well as the semiconductor shortage are driving up production costs which in turn have been passed on to customers,” she continued. “Steel, aluminum, and iron ore prices have surged since the onset of COVID. The price of aluminum surged 50% between Q3 2020 and Q3 2021 while the price of iron ore increased by a similar magnitude within the same timeframe. Commodity prices will likely remain elevated for the foreseeable future as Russia’s war on Ukraine continues to wreak havoc on the supply of raw materials and the cost of energy soars.”

Interact Analysis foresees the average selling prices for mobile hydraulic components increasing between 1.6 and 2.1% annually through 2026 due to the rise in material costs. Jackson said price increases will likely slow down after 2023 but remain on an upward trajectory. “Over the long term, newer, more expensive hydraulics technology will begin substituting tradition hydraulics technology. As this happens, we expect rising average selling prices.”

Among these newer technologies will be further integration of electronics and software with hydraulics to make them more efficient, and due to the push toward further electrification.

According to Jackson, while conducting research for the mobile hydraulics report she and her colleagues found electrification was not increasing demand for hydraulic alternatives at the rate they anticipated. Cost remains a higher priority than efficiency for many OEMs, and uptake of alternatives such as electromechanical components is therefore slow. Part of the reason for this is a reluctancy to change vehicle architectures.

“Improvements to hydraulic architecture are being overlooked by vehicle OEMs, yet, without these improvements, full electrification for off-highway vehicles will be virtually impossible,” she said.

However, OEMs are expected to begin putting more emphasis on efficiency in the coming years which will lead to the use of newer hydraulic technologies.

Jackson noted hydraulic pumps show the highest growth rates “across all regions and sectors with an overall CAGR of 3.8% in the total global market.” She said this is due to pumps being the least likely to be displaced as hydraulic architectures evolve.

“Modifying hydraulic architecture for pumps means making them smarter and able to withstand higher pressure,” she explained. “Decentralizing hydraulic architecture could boost the pumps market as this would call for individual actuators to be controlled by their own dedicated pump.”

Jackson concluded that in 2023, growth in the mobile hydraulics market will decelerate to 4.4%. “This will primarily be due to the supply chain stabilizing. To a lesser degree, higher interest rates may also cause the market to cool by causing businesses to reduce capital expenditure. We expect the next lull in the market to last from 2023-2025.”

Editor’s Note: Power & Motion's Women in Science and Engineering (WISE) hub compiles our coverage of gender representation issues affecting the engineering field, in addition to contributions from equity seeking groups and subject matter experts within various subdisciplines.