Hydraulic components and systems have played an important role in the functionality of excavators, tractors and other mobile applications for many years. And according to 93% of respondents to a Power & Motion survey, they remain a key technology of choice in mobile machines and vehicles.

The power density of hydraulics continues to be unmatched in many applications by electric alternatives. While some examples exist of hydraulics being replaced by electric systems, for now they are limited and in more compact machines.

However, this does not mean hydraulics are not evolving to meet various industry and OEM requirements. Quite the opposite in fact; a common phrase heard time and time again from those working in the fluid power sector is that it is an exciting time because of the many technological developments taking place in the industry today.

Major Industry Trends Driving Hydraulic System Designs

Several factors are influencing how today’s hydraulic components and systems are designed. Ken Baker, CEO of Bailey International, said digitization, which includes the addition of sensors to products, and efficiency are the trends he sees most influencing hydraulic component designs.

He said efficiency is a particularly significant one because of customers’ emphasis on reducing their energy consumption which leads to cost and emissions savings.

Jeff Herrin, Senior Vice President, Research & Development at Danfoss Power Solutions, agreed that efficiency is a key driver because there is a greater focus on the environmental impact of machines and their components which is shaping how hydraulics are designed.

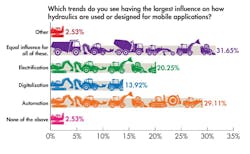

These and many of the other influencers on hydraulic system designs are related to the major trends impacting a number of industries, including fluid power and mobile equipment – automation, digitalization and electrification. The majority of respondents to Power & Motion’s survey said they are seeing equal influence from all three of these trends on their hydraulic systems used in mobile applications, followed closely by 29% saying automation is having the largest influence.

Christopher Griffin, Business Development Manager - Electrification, Motion Systems Group at Parker Hannifin, told Power & Motion that hydraulic systems are getting smarter and more connected which will aid in achieving higher levels of autonomy as well as monitoring of machine performance and maintenance requirements.

Herrin also noted this growing trend, indicating that to make machines smarter it is necessary to develop intelligent components. This will enable full autonomy and lower levels of automation, such as automating a specific machine function, which he said is just as valuable.

With the move to smarter and more automated systems, Herrin said the control system for hydraulics will almost always be software driven. In addition, controls are moving away from the centralized design traditionally utilized to being component based which will offer more flexibility for optimizing machine performance.

The majority of survey respondents, 81%, agreed with Herrin that hydraulic system architectures are changing. One respondent noted this is being driven by the need for greater controllability though digital interfaces, improved modularity, greater total system performance as well as the implementation of software-defined performance.

READ MORE: How Connected and Software-Defined Vehicles are Reshaping System Architectures

Other respondents also noted the change to system architectures being driven by the need to improve efficiency. Additional drivers include the need to reduce machine complexity and the integration of other technologies such as electronics and artificial intelligence (AI).

Hydraulics Remain Technology of Choice Despite Increased Electrification

Electrification is another major trend impacting hydraulic system development, with 20% of survey respondents indicating as such, but how much continues to vary. Of those who said it is impacting their design and use of hydraulics in mobile applications, 32% said it is having an impact of 21% or more but was followed closely by 29% saying 0-5% of their designs are impacted.

Baker, Herrin and Griffin all agreed electrification is influencing the mobile hydraulics industry and like the survey respondents indicated it is in varying degrees. Baker said his company is starting to see increased use of electrical prime movers such as electric direct-drive systems or ePTOs (electric power take-offs) but this remains in the early stages for Bailey’s mid-market customer base.

Herrin, on the other hand, said Danfoss is seeing a rapid increase in customer inquiries for hydraulic system optimization for hybrid- and full-electric vehicles. He said the industry is moving into the second wave of electrification in which early adopters are now able to focus on optimizing hydraulic systems. Initial developments were focused on replacing hydraulic motors with electric versions in propel applications as many OEMs did not have the capacity to optimize systems.

READ MORE: 5 Factors Driving Uptake of Electric Construction Equipment

As electrification progresses – both in the form of electric powered machines and greater incorporation of electric technologies – there continues to be the question as to whether or not electric alternatives will replace hydraulic systems in mobile applications. The general consensus is that there are some instances in which it makes sense, such as rotary applications like wheel drives said Herrin, but the power and force provided by hydraulics remains greater than what can be achieved by electric noted Baker.

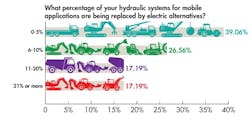

Most survey respondents appear to be in agreement, with most indicating 10% or less of their hydraulic systems for mobile applications are being replaced by electric alternatives.

In those instances where electric is replacing hydraulic, reasons noted by survey respondents include reduced maintenance, weight, and thus fuel, savings, lower noise emissions, and the push to electrify driven in many instances by government regulations. Improved ease of use, energy efficiency and control were also indicated as reasons some applications are making the move to electric in place of hydraulic.

The important aspect to remember though is that it is some applications because as one respondent said “just because automobiles have become a successfully converted technology, doesn't mean that every hydraulic application can equally be converted. Electrification makes sense in some areas, but in many applications the same robustness, durability, and effectiveness just isn't there yet.”

This same sentiment was expressed by Baker, Herrin and Griffin as well. As Griffin put it, there are many electric solutions for hydraulic applications but there are pros and cons to utilizing them. All-electric systems offer efficiency and control advantages but can be more costly, especially when getting into higher force and power requirements. He said they also get heavier in these instances.

He went on to say there will be applications in which all-electric motion systems make sense but there will not be a complete replacement of hydraulics in the mobile machinery market in the foreseeable future.

Survey respondents agreed that hydraulics used in mobile applications are not going anywhere with the majority, 83%, indicating as such. In conjunction, most – almost 97% – see continued development opportunities for mobile hydraulics as do Baker, Herrin and Griffin.

Herrin noted potential opportunities include achieving higher speeds and efficiency in hydraulic pumps and motors without negatively impacting power density. It will be important to get these components to a point where they are comparable with electric options, he said, while maintaining the inherent strength of hydraulics.

The National Fluid Power Association’s (NFPA) 2023 Technology Roadmap points to several areas in which fluid power manufacturers can focus their development efforts to not only meet evolving customer requirements but also maintain the relevancy of hydraulics and pneumatics used in an array of applications including mobile machinery.

Although there are many new technologies and design challenges coming into play, it is clear there are also many opportunities for the use and advancement of mobile hydraulics.

About the Author

Sara Jensen

Executive Editor, Power & Motion

Sara Jensen is executive editor of Power & Motion, directing expanded coverage into the modern fluid power space, as well as mechatronic and smart technologies. She has over 15 years of publishing experience. Prior to Power & Motion she spent 11 years with a trade publication for engineers of heavy-duty equipment, the last 3 of which were as the editor and brand lead. Over the course of her time in the B2B industry, Sara has gained an extensive knowledge of various heavy-duty equipment industries — including construction, agriculture, mining and on-road trucks —along with the systems and market trends which impact them such as fluid power and electronic motion control technologies.

You can follow Sara and Power & Motion via the following social media handles:

X (formerly Twitter): @TechnlgyEditor and @PowerMotionTech

LinkedIn: @SaraJensen and @Power&Motion

Facebook: @PowerMotionTech

Leaders relevant to this article: