New OEM Design Cycles, Reduced Lead Times to Benefit Hydraulics Market

The hydraulics industry has faced several market challenges in 2024, including the lingering effects of supply chain challenges brought on during the COVID-19 pandemic.

According to Tim LaCrosse, Business Development & Application Engineering Manager at Parker Hannifin, lead times are starting to normalize for some hydraulic components. However, market conditions remain a mixed bag as some segments are experiencing increased demand due to easing of supply chain pressures while others are down because of excessive inventory levels.

He also noted that many OEMs are entering their next machine design cycle, which should benefit the hydraulics market in the coming year. In addition, there are many technological developments taking place, including those to meet the needs of electric- and hydrogen-powered machines, that will bring opportunities for the hydraulics market as well.

Power & Motion spoke with LaCrosse about market conditions for the hydraulics sector as well as the many technological developments that will help shape the future of hydraulic system designs.

*Editor's Note: Questions and responses have been edited for clarity.

Power & Motion: How has 2024 been for Parker Hannifin and the hydraulics industry as a whole?

Tim LaCrosse: We started out in 2024 with significant backlog from COVID demand which still caused product lead time issues for some of our components. We have seen that normalize with our lead times returning to pre-COVID levels, and we expect those to reduce further based on significant capital investment into our business. The industry is mixed with some markets increasing production based on reduced supply chain pressures and some markets are down due to excessive inventory levels and demand.

Visit our State of the Industry page for more economic and technology market trend information related to the hydraulic, pneumatic and electromechanical motion control industries.

Power & Motion: What have been some of the biggest challenges, and opportunities, in 2024?

Tim LaCrosse: Markets that are down are under cost pressure, which includes the hydraulic system components. This market challenge is also an opportunity for Parker since we are a full system supplier. We have the opportunity to work with our OEMs to reduce cost through system optimization while simultaneously increasing productivity.

Many OEMs are also entering their next machine design cycle where we are getting many opportunities to work with current and new OEMs on their next generation equipment. Some of these customers have limited design resources which is an opportunity for Parker to assist the hydraulic system design while the OEM focuses on the balance of their machine design, enabling simultaneous engineering activities. This reduces our OEMs' design cycle and improves their time to market.

Power & Motion: What features or capabilities are customers currently looking for from hydraulic components and systems?

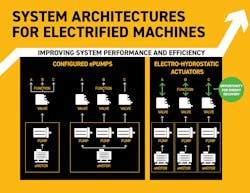

Tim LaCrosse: In traditional hydraulic systems, OEMs are looking to improve system efficiency and machine productivity while reducing carbon emissions and overall cost. OEMs are also designing electrified next generation equipment (hybrid or full electric) and looking to Parker for smart components and best-in-class electric technology. We also see a lot of interest in hydrogen systems where we are uniquely positioned to assist through a total system approach including all the fluid conveyance and thermal management requirements.

Power & Motion: What industry trends are currently having the largest impact on your hydraulics designs, and could you offer examples of specific ways in which they are being impacted?

Tim LaCrosse: Overall machine intelligence, clean technology and the inclusion of more software and controls are impacting hydraulic system design. This requires smart, best-in-class performance components that can plug and play and “connect” seamlessly. These advanced systems provide intelligence and reduce machine downtime by predictive maintenance capability through IoT (Internet of Things) connectivity (Parker’s or the OEM's).

In addition, clean technology system design presents a new complexity for our customers to optimize hydraulic efficiency to extend battery life. These systems require more system capability and engineering bandwidth to implement.

Power & Motion: Are there any new trends or technology needs you see entering the hydraulics market and influencing future designs? If so, what are these and what impacts do you see them having?

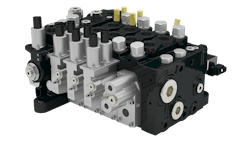

Tim LaCrosse: Electrification and smarter components are enabling alternative system designs. We are utilizing our product technology advancements to leverage these capabilities in new systems design such as positive control, intelligent meter in/out and energy regeneration, among others. Next generation system designs will utilize all these technology advancements and may include distributed/compact hydraulics, [and] higher/optimized pressure capabilities to help improve overall system efficiencies.

Power & Motion: What opportunity areas do you see for hydraulics in the coming 1-2 years?

Tim LaCrosse: Hydraulic technology opportunities are significant as most of our markets are transitioning into their design resources for their next platform designs. Hydraulics are still the technology of preference even on electrified equipment due to the power density. Some of our customers are opting for semi-electrified products and sub-systems vs. fully electrified/hybrid systems.

Power & Motion: Many market reports indicate 2025 will be the start of better market conditions for many sectors — so how are you and Parker Hannifin as a company feeling about 2025? And what factors are influencing your perspectives on the coming year?

Tim LaCrosse: We are cautiously optimistic for most of our markets in 2025. Primary drivers for this improved outlook are lower dealer inventory levels as well as better interest rates which will drive capital investment.

About the Author

Sara Jensen

Executive Editor, Power & Motion

Sara Jensen is executive editor of Power & Motion, directing expanded coverage into the modern fluid power space, as well as mechatronic and smart technologies. She has over 15 years of publishing experience. Prior to Power & Motion she spent 11 years with a trade publication for engineers of heavy-duty equipment, the last 3 of which were as the editor and brand lead. Over the course of her time in the B2B industry, Sara has gained an extensive knowledge of various heavy-duty equipment industries — including construction, agriculture, mining and on-road trucks —along with the systems and market trends which impact them such as fluid power and electronic motion control technologies.

You can follow Sara and Power & Motion via the following social media handles:

X (formerly Twitter): @TechnlgyEditor and @PowerMotionTech

LinkedIn: @SaraJensen and @Power&Motion

Facebook: @PowerMotionTech

Leaders relevant to this article: