Trump Tariffs Causing Uncertainty for Fluid Power Industry

Editor’s Note: Information in the sidebar at the end of this article has been updated as of Feb. 14, 2025 with the latest tariffs information. The Trump administration’s implementation of tariffs on goods imported into the U.S. is a continually evolving situation. Information contained in this article is accurate at the time of publishing and updates will be added as new details emerge.

Tariffs, a tax placed on imported or exported goods, were a key talking point during Donald Trump’s presidential campaign. Throughout his campaign he suggested placing tariffs on goods coming into the U.S. from a number of trading partners including China, Europe and others.

This left many companies, including those in the fluid power industry, wondering what the impact would be if the tariffs were put in place. During the National Fluid Power Association’s (NFPA) Fall Economic Webinar held in November 2024, presenter Lauren Saidel-Baker, CFA, economist at ITR Economics said tariffs typically lead to prices going up.

Saidel-Baker explained that the goal of tariffs is to protect domestic production by making cheaper foreign production more expensive. As such, this could lead to higher prices for companies sourcing components or materials from other countries to make their goods, including hydraulics and pneumatics suppliers.

Read “Will Tariffs Alter the Business Outlook for Fluid Power?” to learn more about the potential market implications of tariffs and take our quick survey at the end of the article to let us know your thoughts on how this trade policy could impact the fluid power industry.

On February 1, President Donald Trump announced the implementation of tariffs on goods imported into the U.S. from Canada, Mexico and China. Shortly after this, Canada and Mexico announced their own tariffs on goods imported from the U.S.

However, on February 3 the three North American countries agreed to a 1-month pause on tariffs. (See sidebar at the end of this article for additional details.)

Although delayed for now, the tariffs could still be a factor after the 1-month pause. And there are still tariffs on Chinese goods which is a large supply source for many companies. Tariffs imposed on goods imported into the U.S. from other countries are still possible as well.

Given the ongoing tariff situation and its potential effects on the hydraulics and pneumatics sector, Power & Motion spoke with members of the industry to get their input on how business conditions may be influenced by this trade policy.

How the Fluid Power Industry is Reacting to Tariffs

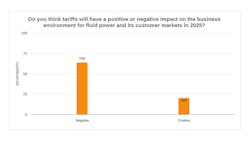

Since December, Power & Motion has been running a brief survey to gauge whether the fluid power industry feels potential tariffs imposed by the Trump administration will have a positive or negative effect on the hydraulics and pneumatics sector.

From those who have responded to date, the majority see the tariffs having a negative impact on the business environment for the fluid power industry and its customer markets, with 76% of respondents indicating as such and 24% saying they see positive impacts from the tariffs.

Upon President Trump announcing the tariffs on Canada, Mexico and China, Power & Motion reached out to members of the fluid power industry to get their input on how these tariffs could impact the sector going forward.

Ken Baker, CEO of Bailey, said the company anticipates some degree of disruption to its business. This comes at a time when he said it seems “markets and customers were just starting to turn the corner on business cycle improvement.”

Baker said Bailey anticipates impacts to its operations in both the U.S. and Canada. He foresees U.S. operations will experience price increases on honed tube and chrome rod due to the tariffs on Mexican and Canadian steel.

Rance Herren, CFPSD, AI, Director – Technical Services at Fluid Power SME and member of Power & Motion's editorial advisory board, agrees there will be impacts to manufacturing costs for components originating from Canada, Mexico and China. “To what degree is unknowable in the near term,” he noted.

He said the biggest challenge he sees the industry facing is determining if the increased costs can be absorbed or whether alternate sources must be established. “Depending on the complexity of the components, the actual impact on the manufacturing costs as well as the installed base of equipment that must be supported with equivalent spares…I believe most businesses in the short term will wait and see before making significant changes,” said Herren.

Watch the video below for a discussion between Power & Motion and editors from sister publications at Endeavor Business Media to learn more about how tariffs may impact various industries.

“The speed with which these tariffs were implemented has left us uncertain about how to proceed,” noted Baker. He said the company is rapidly working on making decisions on how to move forward and for the moment it plans to pass along additional tariff costs to customers which may hinder future business. “We expect that costs passed through to customers will cause end-product [price] increases and business reduction.”

Tolomatic, on the other hand, is looking at alternate sources for those components it imports from China. “We have been working for the past 24 months on reducing our dependency on China-sourced components,” said Paul Carlson, President & CEO of Tolomatic Inc and member of Power & Motion's editorial advisory board. “We have established non-Chinese sources for all the components that we currently purchase from Chinese vendors. We are now able to flex toward sourcing from several different countries, including the U.S. as economic conditions dictate.”

However, Carlson noted it will be a major challenge to move from well-established and qualified Chinese vendors to second source vendors located in other countries. “Today, component pricing from China is very competitive,” he said.

In general, the tariffs are likely to pose additional difficulties for the fluid power sector after experiencing tough market conditions in 2024.

“We see no business benefit from these tariffs,” said Carlson. “These tariffs make our business more expensive and less competitive. They also harm our customers who are dealing with similar challenges.”

Learn more about the impacts tariffs are having on various industries in these articles from other Endeavor Business Media publications.

Condemnation of Trump's New Tariffs from Auto, Consumer Goods Groups from IndustryWeek

Trump's new tariffs draw concern from PLASTICS, other sectors from Plastics Machinery & Manufacturing

Trump pauses tariffs on Canada and Mexico, but China still in the crosshairs — what it means potentially for biopharma from Pharma Manufacturing

Maintenance Mindset: What’s next for Trump’s tariffs, and how quickly will manufacturers feel the effects? from Plant Services

Why Trump’s tariffs spell bad news for trucking’s recovery from FleetOwner

Trump Tariff Situation 'Fluid,' Says TIA from Modern Tire Dealer

Auto Care Association Voices Concern Over Tariffs' Impact on Supply Chain from Ratchet + Wrench

“There may be a limited increase in domestic production of product, but we expect that increases in steel pricing will mute this impact,” said Baker. “Overall, the tariffs will be negative to our markets. Furthermore, the complexity of dealing with the tariff will cause unnecessary efforts with our sales team, our supply chain team and our customers.”

Herren, however, said there is some potential benefit to the tariffs if it leads to companies establishing operations in the U.S. as a result. Since the COVID-19 pandemic there has been a wave of companies re-evaluating their supply chains, with many building up operations in the U.S. or nearby locations such as Mexico.

“If U.S.-based manufacturers that have offshored operations in the areas impacted by tariffs and as a result, begin to produce those products domestically, then there could be a benefit but that is a much longer-term proposition with its own set of problems,” he said.

Among those challenges is the time it takes to establish such operations and the lack of skilled labor available for manufacturing and related industries which will only continue as more of the current labor force reaches retirement age.

Herren also noted that the situation is a bit of a double-edged sword. “The equipment manufactured in the U.S. destined for Canada, Mexico, China or any other country involved in a trade war will cost more to produce and could drive customers to other foreign sources. This is to say nothing of possible embargos of U.S.-made products,” he concluded.

The Current Tariff Situation

President Trump announced on February 1 a 25% tariff on goods imported into the U.S. from Canada and Mexico. Oil and gas imported from Canada, however, would only be subject to a 10% tariff.

The president also announced an additional 10% tariff will be implemented for goods imported from China. These are on top of the tariffs put in place during Trump’s first term of up to 25% on Chinese goods and kept in place by the Biden administration.

President Trump’s new tariffs are set to go into effect on Tuesday, February 4. Upon announcement of the tariffs, both Canada and Mexico announced retaliatory tariffs on goods imported into their countries from the U.S.

The Canadian government outlined imported U.S. goods it will subject to 25% tariffs, including some relevant to the hydraulics and pneumatics sector:

- air or vacuum pumps, air or other gas compressors and fans

- machinery, plant or laboratory equipment

- construction equipment and agricultural machinery

- tools for working in the hand, pneumatic, hydraulic or with self-contained electric or non-electric motor.

After meeting with Mexican President Claudia Sheinbaum and Canadian Prime Minister Justin Trudeau on February 3, the Trump Administration has agreed to a 1-month pause on tariffs for good imported from Mexico and Canada. Tariffs on U.S. goods are halted as well.

China is also putting retaliatory tariffs in place. The country announced on February 4 that up to a 15% tariff will be placed on some U.S. goods imported into China. These goods include goal, liquefied natural gas (LNG), pickup trucks and agricultural machinery — one of the top customer markets for the fluid power industry.

On February 11, President Trump issued an executive order for 25% tariffs to be placed on steel and aluminum imported into the United States beginning March 12. To date there are no provisions on these tariffs. This was followed 2 days later by a presidential memorandum to develop reciprocal tariffs on all imported goods from global trading partners. More information on these newest tariffs can be found in the article "Trump Wants Reciprocal Tariffs on All Imports: DC Watch" from Endeavor Business Media partner site IndustryWeek.

About the Author

Sara Jensen

Executive Editor, Power & Motion

Sara Jensen is executive editor of Power & Motion, directing expanded coverage into the modern fluid power space, as well as mechatronic and smart technologies. She has over 15 years of publishing experience. Prior to Power & Motion she spent 11 years with a trade publication for engineers of heavy-duty equipment, the last 3 of which were as the editor and brand lead. Over the course of her time in the B2B industry, Sara has gained an extensive knowledge of various heavy-duty equipment industries — including construction, agriculture, mining and on-road trucks —along with the systems and market trends which impact them such as fluid power and electronic motion control technologies.

You can follow Sara and Power & Motion via the following social media handles:

X (formerly Twitter): @TechnlgyEditor and @PowerMotionTech

LinkedIn: @SaraJensen and @Power&Motion

Facebook: @PowerMotionTech