Fluid Power Shipments Close Out 2024 on Downward Trend

The National Fluid Power Association (NFPA) has published its latest data for fluid power shipments and orders in December 2024.

According to the data, total fluid power shipments decreased 2.5% from those recorded in November 2024 and were down 11.4% compared to the previous year. November's shipments were also lower compared to the previous month and year, demonstrating the downward trend experienced throughout much of the year for the fluid power sector.

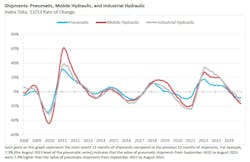

Per NFPA, the 3/12 and 12/12 rates of change for total fluid power, hydraulic, and pneumatic shipments are negative and trending downward. The below table shows the rates of change for shipments in December 2024.

High interest rates and inventory levels were a factor for many hydraulics and pneumatics companies, as well as their customer segments, in 2024. This led to decreased demand for machinery and the components utilized within them.

Ken Baker, CEO of Bailey, noted in an interview with Power & Motion reduced farm incomes contributed to struggles for the agricultural equipment market in 2024 — one of the largest customer segments for fluid power, hydraulics in particular. In addition, slower activity in the residential construction sector contributed to dampened demand for the forestry and construction equipment sectors.

The below shipments graph confirms the decrease in activity in 2024 for the pneumatics, mobile hydraulic and industrial hydraulic segments of the fluid power industry. Baker said non-residential construction was one of the brighter spots for the industry in 2024, but in general all three segments saw lower shipments activity.

Andy Thedjoprasetyono, Manager, New Product Marketing at SMC. Corp., told Power & Motion that a factor for some businesses in 2024 was the U.S. presidential election. Uncertainty surrounding its outcome — and the potential policies put in place that could impact business operations — led many organizations to delay investments in capital expenditures, such as upgrading manufacturing machinery, and thus the need for necessary componentry.

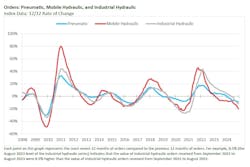

Reduced demand in the mobile and industrial machinery markets equated to lower order activity for the hydraulics and pneumatics sector as well, as depicted in the below graph.

Heading into 2025, there was a sense of optimism for a return to better market conditions for the fluid power industry and its various customer markets. Baker said he anticipated a recovery was likely by the second quarter of 2025 as various markets and overall economic conditions improved.

Tim LaCrosse, Business Development & Application Engineering Manager at Parker Hannifin, said many OEMs were starting to enter their next machine design cycles which would present opportunities for the fluid power market in 2025.

How 2025 will play out for the fluid power market and its various customer segments is yet to be seen. Many economists and market research firms have been predicting improved market conditions in 2025 and the following years. However, there is also some uncertainty at the moment for many businesses due to potential tariffs which could lead to higher prices and supply chain challenges for many businesses, including fluid power companies.

It is clear though that 2024 ended on a down note for much of the hydraulics and pneumatics sector, and it remains a wait-and-see situation for 2025.