Hydraulic and Pneumatic Shipments Decline in February 2025

In February 2025, total fluid power shipments decreased on both a month-over-month and year-over-year basis per the latest data published by the National Fluid Power Association (NFPA).

According to the association's figures, total fluid power shipments decreased 3% from the previous month and 14% compared to Feburary 2024. Declines in shipments and orders was the trend for much of 2024 and so far 2025 is shaping up to be a similar situation for the hydraulics and pneumatics industry.

High interest rates and lower demand from various customer markets were noted reasons for 2024's more difficult market conditions. And while many predicted improvements were on the horizon for 2025, the fluid power industry and its customer markets remain in a state of uncertainty due in part to the continually fluctuating tariff situation.

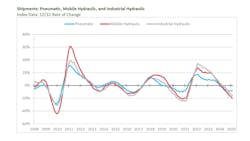

Declines in shipments are being seen in all segments of the fluid power industry. As the below graph shows, pneumatics as well as mobile and industrial hydraulics experienced decreased shipments in February 2025, continuing the downward trend which began for these segments in 2024.

The declines in hydraulic and pneumatic shipments are in line with the customer markets they serve. Agricultural equipment, for instance, continues to see decreasing sales according to the Association of Equipment Manufacturers (AEM). The association's February 2025 tractor and combine report shows sales for both machine types declined again in February, with global trade and tariff concerns cited among the market challenges impacting the industry.

A recent report from Interact Analysis indicates similar difficulty for the industrial sector, also brought on by tariffs. Per the report, some positive signs were starting for the sector 2025 but continued uncertainty brought on by ever-evolving trade policies has kept the industry in a wait-and-see state of mind.

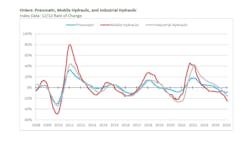

Orders for pneumatic, mobile and industrial hydraulics reflects the ongoing challenges being experienced by the fluid power industry and its customer markets as well. As can be seen in the below graph, orders have been on a downward trend since reaching a high point in the 2022-2023 timeframe.

Per NFPA, the 3/12 and 12/12 rates of change for total fluid power, hydraulic, and pneumatic shipments are negative and trending downward as illustrated in the below chart.

Despite current market challenges, the industry as a whole seems to be optimistic about the future of hydraulics and pneumatics. This was particularly evident at bauma 2025 — a large international trade show for the construction and mining equipment industries. The show was packed with attendees eager to see the latest equipment and components on display. And a number of hydraulics companies were on hand to showcase their latest technology developments, many of which fit in with the larger industry trends of electrification, automation and digitalization.

The charts in this article are supplied by NFPA and drawn from data collected from more than 70 manufacturers of fluid power products by NFPA’s Confidential Shipment Statistics (CSS) program.