Machine Vision Market to Grow Through 2028

In 2024, the global machine vision market is expected to make a turnaround and record single-digit growth of around 1.4% according to recent data from market intelligence specialist Interact Analysis.

This comes after a slower year for the market in 2023 where total revenues reached $6.3 billion, down slightly from the $6.5 billion recorded in 2022. Despite continued growth of automation – a key driver for the use of machine vision systems – price pressures presented challenges for vendors in 2023.

Interact Analysis expects these price pressures to persist through the first half of 2024 before order books begin to refill in the second half of the year, hence the lower growth rate projected for the year. Recovery for the machine vision market is expected to start in 2025 and continue through the decade which the research firm says is in line with its predictions for manufacturing and machinery production growth.

What is Machine Vision?

Machine vision is a concept which brings together various hardware and software tools to help machines see objects. It uses images captured by one or more cameras to gather information and make decisions based on that collected data which may be relayed to other parts of a machine to tell it how to react – such as telling a robot’s pneumatic gripper to pick up an object.

This makes it an important part of many autonomous systems and machines. It is commonly thought of as a technology for robots, both stationary and mobile, as it enables them to detect objects they may need to inspect, pick up or avoid while maneuvering around a facility.

But it can also be used for autonomous driving systems employed in passenger cars and heavy-duty on- and off-highway vehicles. In these applications, machine vision can be used to determine if there are objects in the surrounding area and signal to the vehicle if an evasive maneuver should be taken, such as applying the brakes.

The firm is forecasting that between 2022 and 2028 the global machine vision market will grow by an estimated CAGR (compound annual growth rate) of 6.4%. Revenues for those working in this sector will increase from $6.5 to $9.3 billion during this time. Continued implementation of automation in various industries will help drive this growth.

Positive Conditions for Machine Vision Market Will Vary by Region and Application

According to Interact Analysis’ report on the machine vision market, the Asia-Pacific (APAC) region is expected to provide the most growth opportunity in the coming years because of its stronger customer base.

“Due to the stronger performance of end-customers in APAC, vendors in that region were expected to have had a better year than those with less exposure in 2023,” said Jonathan Sparkes, Research Analyst at Interact Analysis. “In general, APAC suppliers – particularly those in China – took share from those who conduct more of their business in other global regions.”

The applications in which machine vision components and systems are used will play a role in the market’s performance as well.

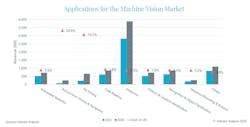

Inspection is the dominant application for the machine vision market, accounting for over 40% of use cases in 2022 per Interact Analysis. This application segment will continue to be the top user of machine vision technology and is forecast to be worth about $3.9 billion by 2028.

Interact Analysis is projecting autonomous driving applications to see the largest CAGR between 2022 and 2028, due in part to the strong outlook for mobile robots. These robots are already being put to use in various industries, particularly manufacturing and warehousing, and their use will continue to grow as a means of helping improve productivity and overcoming the labor challenges facing so many sectors.

The research firm forecasts autonomous driving applications will achieve a CAGR of 20.8% through 2028. Bin-picking will present the second highest growth application with a projected CAGR of 19.2%. Continued deployment of industrial robots in various manufacturing industries will drive growth in this application area.

Sparkes noted there are three key vendors in the machine vision market which account for much of the sector’s revenues. However, new companies continue to enter the market as well, bringing with them new technologies and application uses.

“Despite a plethora of mergers and acquisitions in recent years, the machine vision market is still considered fragmented. New vendors continue to enter the market, with over 200 active worldwide,” said Sparkes. “We are seeing increasing activity from new vendors in China in particular, as well as in those territories where machine vision products are increasingly being used for autonomous driving and bin-picking.”

READ MORE: Motion Control Components Benefit Robot Performance

3D Cameras to be Strong Driver for Market Growth

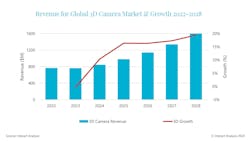

Within the machine vision market, Interact Analysis sees 3D cameras being the product type which will provide the strongest growth potential. This is due to the rising implementation of mobile robots and robotic picking, key users of 3D cameras.

While the machine vision market itself is forecast to grow 6.4%, 3D cameras are expected to achieve a CAGR of 13% through 2028, reaching a value of about $1.6 billion.

Time-of-flight and stereo-vision cameras are anticipated to provide the highest levels of growth. Both can be used to detect objects and are thus often used with mobile robots; therefore, the projected growth of the mobile robots market in the coming years will lead to improved market conditions for these two 3D camera types as well.

Although these two camera types are cheaper than structured light and laser triangulation 3D cameras, they have gained more market share in recent years. Interact Analysis is forecasting stereo-vision cameras will achieve a CAGR of 19% and time-of-flight options a rate of 17.3% through 2028.

The research firm sees continued price reductions being a key driver for the rising use of 3D cameras. This will enable manufacturers to use a single camera in place of several 2D versions while getting the same, if not better, detection capabilities and enabling more compact designs – leading to faster response times for robots as well.

New camera vendors are continually entering the market which is helping to bring down costs as well as improve technological capabilities.

Use of 3D cameras in autonomous driving and bin-picking applications will help this segment’s future growth trajectory as well given these are the application uses with the largest growth potential for the overall machine vision market.

Interact Analysis reports the mobile robot market, where autonomous driving is currently most available, grew 33% in 2022 and further growth is expected in the coming years. The firm also notes that substantial year-on-year growth in sales for picking robots will help drive further expansion of the 3D camera market.

Overall, positive conditions are expected for the machine vision market as sectors such as manufacturing continue to increase their use of automation solutions.

About the Author

Sara Jensen

Executive Editor, Power & Motion

Sara Jensen is executive editor of Power & Motion, directing expanded coverage into the modern fluid power space, as well as mechatronic and smart technologies. She has over 15 years of publishing experience. Prior to Power & Motion she spent 11 years with a trade publication for engineers of heavy-duty equipment, the last 3 of which were as the editor and brand lead. Over the course of her time in the B2B industry, Sara has gained an extensive knowledge of various heavy-duty equipment industries — including construction, agriculture, mining and on-road trucks —along with the systems and market trends which impact them such as fluid power and electronic motion control technologies.

You can follow Sara and Power & Motion via the following social media handles:

X (formerly Twitter): @TechnlgyEditor and @PowerMotionTech

LinkedIn: @SaraJensen and @Power&Motion

Facebook: @PowerMotionTech

Leaders relevant to this article: