Acquisitions and Partnerships to Benefit Machine Vision Market

Interact Analysis is projecting the global machine vision market will return to a period of growth starting in 2024 through 2028. An aspect which is expected to benefit the market is the number of partnerships and acquisitions taking place.

By coming together through either a merger or technology collaboration, companies can broaden their product portfolios to provide customers with more complete solutions. While much of the industrial automation sector and its related technologies – including hydraulics, pneumatics and other motion control solutions – are experiencing a similar trend, although the research firm views it as a particularly strong one currently in the machine vision market.

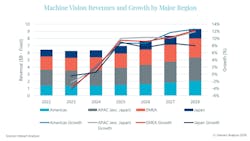

According to Interact Analysis, growth for the machine vision market will be highest in the Americas and EMEA (Europe, the Middle East and Africa) through 2028 as shown in the graph below. It attributes this to the large number of partnerships and acquisitions being made by large machine vision suppliers in these regions.

Not only do these undertakings help to expand product offerings but also entry into new markets.

Companies Gaining Market Share Through Mergers and Collaborations

Interact Analysis reports that there are new vendors coming into the machine vision sector all the time, but larger suppliers continue to gain market share due in part to the number of partnerships and acquisitions they are making. Doing so increases their technology offerings and expertise in the various sectors within the machine vision space, enabling them to better serve customers.

As with many technologies, in-house development can be costly in terms of time and money. Partnering with another company or acquiring it, however, can help to ease and speed up the design of new technology which then enables it to get into the market faster.

READ MORE: How Company Mergers Bring Expanded Market Opportunities

In the table below, Interact Analysis has outlined the global market share for the top 15 machine vision suppliers in 2022 and 2023, many of whom have been undertaking new partnerships and acquisitions to strengthen or maintain their position in this sector.

U.S.-based Cognex Corporation is one such example Interact Analysis points to. In 2023, the company acquired Schott-Moritex (Moritex), a developer of optics components based in Japan. The acquisition helps to increase Cognex’s lens capabilities as well as its share of the Japanese market where Moritex has a strong presence.

Interact Analysis anticipates the additional income that will come from this acquisition and the subsequent technology capabilities as well as expanded market presence will help Cognex to increase its share of the global machine vision market in 2024 and the coming years.

Teledyne Imaging and TKH Vision are other companies Interact Analysis notes which have large shares of the global machine vision market and have undertaken numerous acquisitions in recent years to help achieve this. Both companies now have several companies under their umbrellas, enabling them to serve a range of applications and regional markets.

Teledyne, for instance, recently acquired camera manufacturer Adimec Holding B.V. which is based in the Netherlands. The company will now have a greater footprint in the EMEA region as well as Adimec’s expertise in developing custom cameras for industrial and scientific applications requiring a high level of image quality.

TKH Vision’s acquisitions in recent years have brought many machine vision technologies into its product portfolio including:

- area-scan cameras

- 3D laser-triangulation cameras

- line-scan cameras

- high-end and high-speed cameras

- machine vision components

- 3D stereo cameras and

- smart cameras.

With its various acquisitions and large product offering, the company has been able to establish a strong foothold in the EMEA region which Interact Analysis says will continue to grow as it makes more acquisitions in the future.

More Acquisitions will Create a Consolidated Machine Vision Industry

As industrial automation continues to grow, so too will the amount of machine vision technologies used within automated systems and machines as well as vendors supplying them.

Collaborations between companies will still occur, but Interact Analysis anticipates acquisitions will be the prominent method of obtaining technology in the coming years, leading to a more consolidated machine vision industry.

Similar to other sectors, customers want complete solutions and where possible to have a one-stop-shop experience instead of sourcing components from multiple vendors. By acquiring companies and technologies, machine vision suppliers can add solutions to their offering to meet these customer requirements.

Larger companies who have been in the market for several years will have an easier time with this because of the resources they have available compared to smaller companies entering the industry. As such, Interact Analysis’ table above showing global market share by company may not differ much in the coming years because those companies will continue acquiring other suppliers.

But it is also hard to predict with certainty how the machine vision landscape will evolve with new players coming in and out of the market in the coming years. What is certain though is that it is a growing market sector that will be aided by partnerships and acquisitions that bring new technologies and capabilities into play.

Why does the machine vision market matter?

Machine vision combines hardware and software to help machines see objects, an important capability for the implementation of automation. For instance, it can be used to determine when an item is in reach of a robot arm so that it is picked up and placed where desired.

Hydraulic, pneumatic and electromechanical motion control devices are commonly used in automation systems, and their actuation can be directly influenced by machine vision technologies used as part of those systems.

With the greater emphasis being placed on full system solutions, it is important to understand how related technologies and markets are performing as well as the trends impacting them in the coming years.

READ MORE: Pneumatics Provide a Tried-and-True Technology for Robotics

About the Author

Sara Jensen

Executive Editor, Power & Motion

Sara Jensen is executive editor of Power & Motion, directing expanded coverage into the modern fluid power space, as well as mechatronic and smart technologies. She has over 15 years of publishing experience. Prior to Power & Motion she spent 11 years with a trade publication for engineers of heavy-duty equipment, the last 3 of which were as the editor and brand lead. Over the course of her time in the B2B industry, Sara has gained an extensive knowledge of various heavy-duty equipment industries — including construction, agriculture, mining and on-road trucks —along with the systems and market trends which impact them such as fluid power and electronic motion control technologies.

You can follow Sara and Power & Motion via the following social media handles:

X (formerly Twitter): @TechnlgyEditor and @PowerMotionTech

LinkedIn: @SaraJensen and @Power&Motion

Facebook: @PowerMotionTech

Leaders relevant to this article: