Given the limited supply and high price of battery-grade lithium and other advanced battery materials, alternative battery chemistries are being researched. Some avenues, such as sodium-ion batteries, are yielding the first tangible results. Sodium-ion batteries are one of the most developed technologies today and have the potential to become a viable option in many battery applications in the near future.

The initial commercial success of sodium-ion batteries indicates a potential for substantial growth in this segment. However, new battery technology requires years of engineering for successful commercialization, and with the accelerating demand, there remains a risk of battery shortages in the mid-term future.

CATL, one of the world’s largest lithium battery manufacturers, is launching commercial-scale manufacturing of sodium-ion (Na-ion) batteries to be used in passenger electric vehicles (EV). This may indicate the early market adoption and growth potential for sodium-ion chemistry, replacing lithium-ion (Li-ion) in some battery applications.

By comparing the technological parameters of sodium- and lithium-ion technologies, there can be a better determination of the potential feasibility of using sodium-ion batteries in industrial machinery, such as material handling equipment, and other applications.

Chemical Element Comparison: Sodium vs. Lithium

The first step in comparing battery technologies is examining their chemical makeup and how it could impact various applications.

How Abundant is Each Element?

The natural abundance of sodium (Na), the Earth’s fifth most abundant element constituting 3% of its mass, is remarkably higher than that of lithium (Li), indicating its potential significance in battery production. The concentration of sodium in the Earth's crust is approximately 1,180 times greater than that of lithium, and in the sea, it is an astonishing 60,000 times higher.

These stark differences in availability are presented in Table 1 below:

Cost

One significant advantage of sodium lies in its cost. A simple comparison of prices on the Shanghai Metals Market reveals a striking 20-fold difference in prices of pure sodium and lithium compounds (June 2023):

- Sodium carbonate costs approximately $290 per metric ton.

- Lithium carbonate (99.5% battery grade), on the other hand, commands a significantly higher price of approximately $35,000 per metric ton (even after a sharp decline since mid-July 2022).

The current demand for sodium within the battery industry is negligible, especially in contrast to the surging demand for lithium in Li-ion battery packs. The year 2022 marked a notable milestone for Li-ion batteries, as the prices of battery packs increased for the first time in 12 years since BloombergNEF (BNEF) began tracking prices.

The price reached $151 per kWh, largely due to the soaring demand for batteries driven by the electrification of passenger EVs, as well as electrical industrial equipment and energy storage manufacturing.

READ MORE: The Current State of Battery Technology

Sodium-Ion vs Lithium-Ion Battery Cells

While there are some similarities between sodium- and lithium-ion battery cell designs, understanding how they differ can help determine the best choice for a given application.

Similar Cell Structures and Material Requirements

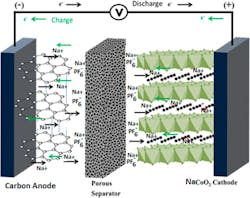

Sodium-ion battery cells, like lithium-ion, are comprised of positive and negative electrodes, a separator, and an electrolyte. Both battery types are based on the "rocking chair" principle: during the charging and discharging processes, positive ions travel back and forth between the two electrodes of the battery, as shown in Figure 1 below from "How Comparable Are Sodium-Ion Batteries to Lithium-Ion Counterparts?"

As it was in the early days of lithium-ion, sodium-ion batteries utilize a cobalt-containing active component. Specifically, sodium cobalt oxide (NaCoO2) which is used as the primary active material for sodium-ion cells, mirroring the use of lithium cobalt oxide (LiCoO2) in lithium-ion cells.

However, as technology advanced and concerns arose about the sustainability and cost of cobalt, the industry began exploring alternatives. In lithium-ion batteries, cathode materials like NMC (nickel manganese cobalt) and NCA (nickel cobalt aluminum) are increasingly being substituted with more abundant and cost-effective LFP (lithium iron phosphate) chemistry. Similarly, researchers and manufacturers are actively working towards substituting cobalt-containing compounds in sodium-ion battery cathodes with more sustainable and economical elements.

The article "What's Inside the Black Box? The Form, Design, and Chemistry of Lithium Forklift Battery Cells" from OneCharge provides a comprehensive understanding of these components and their roles in sodium-ion battery cells. Although it is focused on lithium-ion batteries, the fundamental principles of electrolyte and integrated separator functionality fully apply to sodium-ion batteries.

Comparing Battery Cell Performance

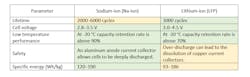

Similarities in specific energy between Na-ion and LFP cells make sodium-ion batteries a potentially well-suited option for applications currently using LFP battery packs. Such applications include EVs, electric buses, industrial and off-highway vehicles, stationary storage, marine and rail transport, and power tools.

Table 2 below compares sodium-ion and lithium-ion battery cell performance, with information sourced from "A non-academic perspective on the future of lithium-based batteries (Supplementary Information)" and "READ MORE: A New Sodium-Ion Battery Design is Worth its Salt

Advantages of Sodium-Ion Battery Packs

Despite the need for more real-world use and testing, there are some clear benefits offered by sodium-ion batteries.

Sustainability

The abundance of sodium in the world's oceans presents a compelling opportunity for large-scale extraction leveraging existing technologies. Presently, brine extraction on the mainland, followed by water evaporation, chemical separation of sodium-containing salts, and subsequent chemical recovery of sodium is a commonly employed method.

However, future advancements could replace this approach with the desalination of seawater, offering the advantage of clean drinking water as a by-product of sodium extraction. This innovative technology has already been extensively discussed in the publication Nature.

Further development of this technology, such as anode-free sodium metal batteries, could help reduce the carbon footprint and energy use during battery manufacturing and recycling processes.

Lower Battery Pack Cost

The specific price for sodium-ion battery packs is lower today and is expected to decrease as production volume grows and further advancements in technology are made. Unlike lithium, there is no foreseeable shortage of raw sodium.

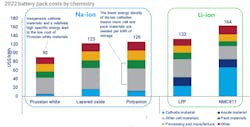

Figure 2 below, from Wood Mackenzie's 2022 battery pack prices per energy unit, shows a price comparison for different types of batteries:

However, per the Global EV Outlook 2023 by the International Energy Agency (IEA), Na-ion batteries currently do not offer the same energy density as Li-ion. With energy densities ranging from 75 -160 Wh/kg for sodium-ion batteries compared to 120-260 Wh/kg for lithium-ion, there exists a disparity in energy storage capacity.

This disparity may make sodium-ion batteries a good fit for off-highway, industrial, and light urban commercial vehicles with lower range requirements, and for stationary storage applications. These applications prioritize cost-effectiveness and sustainability over maximizing the driving range important in a passenger EV.

Gigafactories Can be Quickly Retrofitted

The IDTechEx report "Sodium-ion Batteries 2023-2033: Technology, Players, Markets, and Forecasts" argues that Na-ion is a drop-in technology for the current production lines of Li-ion batteries. This means that if sodium batteries will indeed start to replace lithium in some applications, manufacturers can quickly switch their production lines to the new chemistry.

How Sodium-Ion Could Benefit Material Handling Equipment

Material handling equipment (MHE) has specific requirements based on the particulars of its applications:

- High utilization rates, with up to 18 work hours per day and short breaks. Automated equipment such as automated mobile robots (AMR) and automated guided vehicles (AGV) can work even longer hours.

- Lack of range anxiety as chargers are typically located within the facility of operation, enabling batteries to be frequently and rapidly charged during scheduled and random breaks.

- Harsh industrial environment requires equipment to withstand extreme temperatures, vibration, and moisture.

Given these specific requirements, MHE requires lower specific battery energy (Wh/kg) but higher specific power (W/kg) compared to passenger EVs. If sodium-ion technologies can meet the challenge of delivering higher power and durability, they may indeed have a bright future in the MHE industry.

And unlike with an EV, extra battery weight is often welcome as a counterweight in some vehicles such as fork lift trucks.

There is the potential for simultaneous demand for lithium-ion and sodium-ion forklift batteries with sodium-ion battery packs becoming a direct competitor to TPPL lead-acid batteries, which are currently used in applications with lower power demands.

READ MORE: Construction Equipment Digs Deeper into Electrification

A Potentially Bright Future Ahead for Sodium-Ion Batteries

According to IEA’s Global EV Outlook 2023, there are nearly 30 sodium-ion battery manufacturing plants currently operating, planned, or under construction, for a combined capacity of over 100 GWh, and almost all of them are in China.

For comparison, the total U.S. manufacturing capacity of lithium-ion batteries in 2022 is estimated at 110 GWh.

Within the next few years, we will see if this new technology can be scaled and achieve wide commercialization, or if it will remain a niche product along with many other battery chemistries.

This article was written and contributed by Anton Zhukov, an expert in industrial batteries and uninterruptible power supply and a technical trainer at Schneider Electric, on behalf of OneCharge, a developer of forklift batteries and accessories.

Manufacturers Investing in Sodium-Ion Battery Production

Following are a few key players that have made significant progress in the development and commercialization of sodium-ion batteries to date.

CATL. In July 2021, CATL confirmed the launch of sodium-ion products, signaling its entry into the sodium-ion battery market. In April 2023, CATL announced that Chery passenger cars will be equipped with its EV sodium-ion batteries, indicating a potential growth in commercial adoption.

BYD. In December 2022, BYD said it will mass-produce sodium-ion batteries and incorporate them into their Qin EV, Dolphin, and Seagull models. Other Chinese developers racing to launch sodium batteries for EVs are Farasis Energy and HiNa Battery.

Tiamat. Tiamat is an American start-up focused on designing, developing, and producing sodium-ion technology. The company achieved significant milestones, including the launch of the first 18650 Na-ion cell in November 2015. Tiamat is currently working on the construction of a gigafactory on French soil in the coming years.

Faradion. The British sodium-ion battery technology company Faradion was acquired by Reliance New Energy Solar (RNES) in India. In December 2022, Faradion completed its first sodium-ion battery energy storage installation, showcasing progress in the commercialization of its technology.

Natron Energy. Based in California, Natron Energy is a start-up specializing in sodium-ion batteries. United Airlines is among its investors. Natron is targeting data centers and telecom applications. In April 2021, Natron Energy and Lonza Specialty Ingredients (LSI) announced their agreement for LSI to supply high volumes of Prussian blue materials for Natron’s sodium-ion energy storage products.

About the Author

Anton Zhukov

Leaders relevant to this article: