Geared Products Market to Slow Before Rebounding in 2025

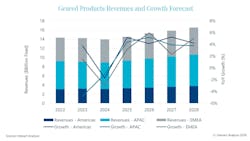

After experiencing strong growth in 2022, the geared motors and industrial gears market declined slightly in 2023. Market intelligence firm Interact Analysis is predicting further contraction for this market in 2024 before returning to a state of growth in 2025.

In its latest research report on the geared motors and industrial gears (collectively termed geared products) market, Interact Analysis found that many suppliers saw a slowdown in order intake during the second quarter of 2023, leading to market revenue contraction for the year.

Final market revenue for 2023 is expected to be $14.2 billion, a 0.7% decline from 2022. The market's strength in 2022 was due in large part to price increases caused by raw material costs, supply chain problems and higher energy prices which led to a 5-10% rise in average selling price for geared products during the year.

Interact Analysis is forecasting a further decline of 1.9% for the global geared products market in 2024. However, steady growth of about 3-5% per year is expected from 2025 through 2028.

This is in line with many current economic forecasts which are calling for a recession in 2024 — little to no growth in many market sectors — followed by more positive growth trends for the rest of the decade.

READ MORE: 2024 Recession Presents Fluid Power Industry Opportunities for Investment

Market Performance to Vary by Region

Asia-Pacific (APAC) is the largest revenue generator for the global geared motors and industrial gears market, accounting for 46% of global revenues according to Interact Analysis, while EMEA (Europe, the Middle East and Africa) holds a 33% share of this sector and the Americas 21%.

However, growth in the APAC region has declined in recent years. Interact Analysis reports that APAC experienced a 2.7% drop in revenues in 2022 and a further contraction of 4.8% is expected for 2023. The research firm says this decline is due to contraction in China, a large user of geared products for its manufacturing industry.

Per Interact Analysis, China is experiencing a property slump which is impacting the country's steel and aggregates sectors. In addition, the strong growth for lithium-ion battery manufacturing facilities after COVID has begun to cool. However, further declines in 2024 for the region are expected to be more narrow as many believe China's economy already hit its bottom end in 2023 and therefore will begin to recover in the coming years.

Interact Analysis expects the Indian and Southeast Asian markets to be stronger drivers of revenue growth for the APAC region in the coming years. Growth was seen in these regions already in 2023; despite a slight contraction predicted in 2024 due to the global economic slowdown, their long-term growth potential remains and thus will benefit APAC's revenue potential for geared products.

The Americas saw the highest levels of growth in 2022, which reached 12%, because of strong demand and currency in the region. This is likely due to the reshoring efforts taking place to enable more localized production and supply chains. In 2023, Interact Analysis expects the region to maintain a reasonable growth rate of 3.8%.

New orders for geared motors and industrial gears have begun to contract in the Americas, a sign the recession predicted by many economists is likely to occur in 2024. While not expected to be a major economic catastrophe like that experienced in 2008, how long it lasts will depend on many factors including interest rates — if they remain at their currenlty high levels for an extended period of time, it could hinder purchasing capabilities and thus demand for products like geared motors.

Revenue growth for EMEA in 2022 was just 1.1% and final 2023 revenues are anticipated to come in at 1.5% for the year. Interact Analysis says this growth is due to stong demand from the region's automotive sector. Average or weak growth is expected for EMEA's other application industries in which geared products are used.

Weaker global demand in 2024 has led Interact Analysis to predict a negative outlook for Europe's machinery production sector and thus the broader EMEA region as a whole.

In its report, Interact Analysis breaks the conveyors sector down into two types — unit and bulk conveyors. Growth for unit conveyors will be driven by continued investments being made in the warehouse, logistics, e-commerce and airport industries. Bulk conveyors are mainly used in the mining and construction industries and therefore their growth will be dependent upon how those sectors perform, which is expected to be positive in the coming years due in part to infrastructure investments in the U.S. and other parts of the world.

Interact Analysis anticipates demand from the warehouse and logistics sector to increase more than that for the heavy-duty industries in the next 5 years, likely due to the strong investments being made in nearshoring and reshoring to better secure supply chains. From 2023-2028, it is forecasting 4.1% annual growth rates for the unit conveyor market and 3.6% for the bulk conveyor segment.

Industry Consolidation is Changing the Market Landscape

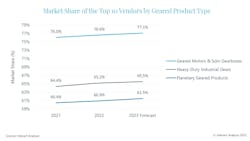

Like many industries, the geared motors and industrial gears market is experiencing a consolidation of suppliers as companies merge with one another or get acquired. Per Interact Analysis, the top 10 suppliers accounted for 62% of the global geared products market revenue in 2022 which was up from 60% in 2021. This upward trend is expected to continue in 2023.

"The leading vendors for the geared products market remain relatively unchanged, but concentration of the supplier base continues. As a result of its acquisition of Altra Motion, Regal Rexnord is now among the top 5 leading global suppliers of geared products," said Samantha Mou, Research Analyst at Interact Analysis, in the firm's press release announcing the availability of its geared motors report.

"Overall, the ranking of other leading vendors remains stable, with SEW Eurodrive retaining its position as the number one vendor globally and across all tri-regions. The EMEA vendor landscape is the most ‘stable’, with all leading suppliers enjoying growth in their specialized areas in 2022."

While there is consolidation happening within the geared products industry, there are also a number of newer suppliers entering the market which are doing so to serve specific regions or product types. Per Interact Analysis, the company WEG has seen fast growth in the Americas for its geared motors while some Chinese vendors are finding business opportunities in EMEA, especially for their worm geared products.

READ MORE: How Company Mergers Bring Expanded Market Opportunities

Interact Analysis anticipates a gradual industry consolidation to continue in the coming years but notes medium and small suppliers could experience rapid growth as well by serving specialized markets.