Fluid Power Shipments Down to Start 2025

Total fluid power shipments were down in January 2025 according to the most recent shipment and order data published by the National Fluid Power Association (NFPA).

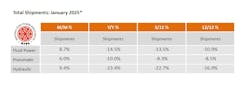

Data shows total fluid power shipments in January decreased 8.7% from the previous month. In December 2024, shipments had been down just 2.5% from those recorded the month prior. Shipments were also down 14.5% from January 2024.

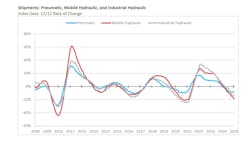

The NFPA data shows the 3/12 and 12/12 rates of change for total fluid power, hydraulic, and pneumatic shipments are negative and trending downward.

2024 was a challenging year for much of the fluid power industry and its customer markets as high interest rates and other factors led to lower demand for machines and componentry. It will likely take some time for the sector to return to more positive territory.

In an interview with Power & Motion, Ken Baker, CEO of Bailey, said he expected 2025 to be a better year and a recovery to begin in the second quarter as markets started to pick up.

The U.S. Federal Reserve (the Fed) and other global banks began lowering interest rates in late 2024 which many economists and those in the industry believed would have a positive effect on various markets. However, the Fed has so far halted any further rate reductions as it waits to see how the economy continues to perform.

Uncertainty continues to be the prevailing theme for the U.S. economy in particular due in part to the Trump administration’s tariff policies. The on-again, off-again nature of the tariffs as well as their continually changing amount and impacted industries is making it difficult for many businesses to plan. There are also many trade and supply chain concerns associated with the ever-evolving tariff situation.

Baker stated in another interview with Power & Motion that the implementation of tariffs came just when it felt the fluid power industry and its customer markets were starting to turn the corner and see business improvements. Baker and other fluid power executives noted the speed at which the tariff situation continues to evolve and the additional business complexity it adds poses many challenges for the fluid power industry.

Read the content below for more information on how the fluid power industry is reacting to tariffs.

The Association of Equipment Manufacturers’ (AEM) tractor and combine report for January 2025 showed a drop in sales for tractors and combines, continuing the difficult market conditions faced by the agricultural equipment industry. Tariffs, trade concerns and lack of assurance on a farm bill were factors noted by AEM which led to slower sales during the month.

As the agricultural equipment industry is one of the largest customer markets for fluid power, this sector’s performance in January likely contributed to the lower orders and shipments for hydraulics and pneumatics during the same time period, as shown in the two charts below.

Although there is uncertainty for many, there are also potential opportunities on the horizon for the fluid power industry. Reshoring efforts continue, and may increase because of tariffs, which could lead to demand for hydraulics and pneumatics used not only in manufacturing machinery but also the equipment that builds production facilities.

Data centers are another growth opportunity as investment in these facilities increases to meet artificial intelligence (AI) and other technological needs. Here again fluid power technologies will play a part in building the facilities as well as within them — fluid conveyance components, for instance, are often used as part of the vital cooling systems used in data centers.

The NFPA data for January 2025 fluid power shipments and orders may not paint a rosy picture, but it is still early in the year and there is time yet for the outlook to improve.

The charts in this article are supplied by NFPA and drawn from data collected from more than 70 manufacturers of fluid power products by NFPA’s Confidential Shipment Statistics (CSS) program.