Fluid Power Shipments Drop in April 2025

Shipments for fluid power components and systems were down once again in April 2025 according to the most recent data published by the National Fluid Power Association (NFPA).

Per the data, total fluid power shipments decreased 4.8% from the previous month and were 8.9% below April 2024’s index. This follows a relatively consistent pattern of shipment decreases over the past year, although there was a slight rise in March 2025.

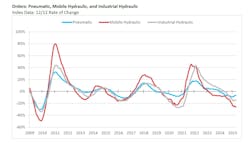

NFPA’s data shows the 3/12 and 12/12 rates of change for total fluid power, hydraulic, and pneumatic shipments are negative, and their movement appears to be plateauing.

What this plateauing means remains to be seen. Those who had anticipated better market conditions in 2025 had noted that recovery would take some time, possibly going into effect in the second quarter and beyond.

Catch up on the latest tariffs news in "Trump Increases Tariffs on Steel and Aluminum: DC Watch" from IndustryWeek, an Endeavor Business Media partner site which has been tracking the various tariff updates as they happen.

However, at the moment, the continuously changing tariff situation continues to bring uncertainty for many businesses and their customers, leading some to hold off on making larger capital investments until there is more clarity on this trade policy. Because of this, several market analysts have altered their outlooks for both the mobile and industrial machinery markets.

Industrial Applications Performing Slightly Better than Mobile

As the below charts from NFPA show, shipments and orders for pneumatics and industrial hydraulics have fared slightly better than those for mobile hydraulics. The industrial sector started 2025 on a more positive note with organizations such as Interact Analysis reporting that machinery orders began to pick up in January and February.

The Association for Manufacturing Technology (AMT)’s most recent U.S. Manufacturing Technology Orders Report shows new orders for metalworking machinery in March 2025 reached the highest monthly value since the same month in 2023. Orders increased 33.8% compared to February 2025 and 20.5% from the same month a year ago.

The association did note in its report that orders of manufacturing technology were down 5.7% in the first quarter of 2025 compared to the previous quarter, but that it is seeing upward momentum in this sector.

Mobile machinery, including construction and agricultural equipment, continues to experience challenging market conditions. Elevated interest rates, and thus costs, continue to present challenges for the construction market, and thus demand for new machinery.

Agricultural machinery sales in the U.S. remained down in April 2025 reported the Association of Equipment Manufacturers (AEM), though tractor sales in Canada rose again during the month. Curt Blades, Senior Vice President of Association of Equipment Manufacturers noted slow tractor and combines sales in the U.S. could be attributed to factors including increased input prices, high interest rates and global trade concerns.

With demand subdued for construction, agricultural and other off-highway equipment, mobile hydraulic shipments and orders have also remained lower.

These conditions are not expected to last forever though. Blades noted in AEM’s report that there is optimism for improved conditions in the agriculture market as planting season begins. And as many OEMs have entered their next design cycle, there is plenty of development work taking place in the fluid power industry. Some companies in the hydraulics and pneumatics sector have also noted how busy they are currently, helping signify the work still taking place in the industry.

Automation, data centers and a number of other applications are presenting opportunities for fluid power as well which should bode well for the industry in the coming years.

About the Author

Sara Jensen

Executive Editor, Power & Motion

Sara Jensen is executive editor of Power & Motion, directing expanded coverage into the modern fluid power space, as well as mechatronic and smart technologies. She has over 15 years of publishing experience. Prior to Power & Motion she spent 11 years with a trade publication for engineers of heavy-duty equipment, the last 3 of which were as the editor and brand lead. Over the course of her time in the B2B industry, Sara has gained an extensive knowledge of various heavy-duty equipment industries — including construction, agriculture, mining and on-road trucks —along with the systems and market trends which impact them such as fluid power and electronic motion control technologies.

You can follow Sara and Power & Motion via the following social media handles:

X (formerly Twitter): @TechnlgyEditor and @PowerMotionTech

LinkedIn: @SaraJensen and @Power&Motion

Facebook: @PowerMotionTech