Mobile Robots to Remain Strong Segment of Automation Sector

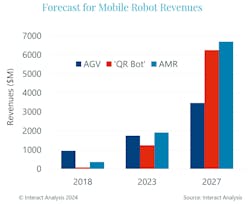

Mobile robots are one of the fastest growing sectors within the automation industry. It was worth about $4.5 billion in 2023 and has tripled in size over the last 5 years said Ash Sharma, Managing Director, Interact Analysis during a presentation at Automate 2024 on the mobile robot market.

Despite the overall manufacturing industry and global economy not being as strong, he said Interact Analysis is projecting continued growth for mobile robots over the next 5 years.

“The reason for [this growth] is underlying macro drivers that are getting stronger – lack of labor, rising labor costs, trends to flexible manufacturing, reshoring, [and] proliferation of ecommerce,” he said. “These trends are global; they are affecting pretty much every economy around the world. And that's driving the need for automation and mobile robots.”

Robots in Fulfillment Centers to Experience Exponential Growth

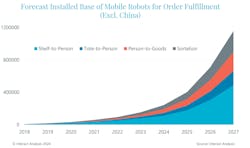

By 2027, Interact Analysis expects 2.7 million mobile robots to be installed around the world (excluding those made by retailers such as Amazon for use in their own facilities). The majority of this volume is comprised of robots used for order picking and fulfillment.

Sharma said near exponential growth is expected for mobile robots used in order fulfillment applications through 2027. This is because of the maturity level the industry has now reached.

Over the last 5 years, manufacturers have been testing out mobile robot technology and piloting it at small scales. Now they’ve reached a stage where instead of 10 robots they are buying hundreds of robots for use in facilities around the world. “They’re speeding up the pace of deployment,” he said. “We’re seeing project sizes getting faster, bigger and done quicker which then lead to this exponential growth.”

In the U.S., about 1 in 10 fulfillment centers and 1 in 100 distribution centers now have mobile robots. As the market continues to grow, so too will this penetration rate to about 1 in 3 fulfillment centers having mobile robots by 2027. “But the distribution center [segment of the market] is still largely under penetrated,” said Sharma.

Market Opportunities for Material Transport Robots

Mobile robots used for material transport applications, which are typically utilized in distribution centers and manufacturing facilities, present a large opportunity for the market. Sharma said it is a larger portion of the market than order fulfillment as there are 176,000 warehouses around the world and another 107 million manufacturing facilities in which material transport robots could be used.

Besides the many trends driving the growth of automation, legislation such as the CHIPS Act and Inflation Reduction Act in the U.S. are driving reshoring efforts and high-value manufacturing of products like semiconductors and thus demand for automation.

READ MORE: How the CHIPS and Science Act Will Benefit Fluid Power and Motion Control Manufacturers

Another potential opportunity for this segment of the mobile robot market is automation of fork trucks (also called forklifts). Sharma said over 2 million of these vehicles are sold each year but only a small portion of them are currently automated. Given the importance of these vehicles in moving materials around facilities and the labor challenges facing the manufacturing industry, automating fork trucks could prove beneficial for many.

Interact Analysis is forecasting the material transport robot market to be worth over $7 billion in 2027. The majority of these robots will be for conveying applications, so moving material from one point to another, followed by those for lifting applications. Robots for towing applications will account for the smallest percentage of the market, but like those for other applications, are on a growth trajectory due to the benefits offered by automation of this task.

Sharma noted that despite strong growth projections, low penetration rates are forecast for mobile robots in production lines. “It shows how much headroom there is for growth in this industry,” he said.

Manufacturing Sectors Offering the Best Potential

Several segments of the manufacturing industry are seen as opportunity areas for mobile robots in the coming years. Automotive is one of the largest, forecast to be worth over $1.5 billion for mobile robots in 2027 said Sharma.

He said it was one of the first industries to adopt fixed robots and is now rapidly adopting autonomous mobile robots (AMR). Production lines are being redesigned to aid the transition to electric vehicles (EV) as well as the need to produce batteries for EVs, aiding the uptake of automation technology like AMR.

What is a mobile robot?

A mobile robot uses sensors, software algorithms and other technologies to move through an environment. There are differences in the types of sensors used and how they navigate, but the goal is the same with every type – moving material either by pulling, carrying, lifting or picking.

Mobile robots are typically categorized as automated guided vehicles (AGV) or autonomous mobile robots (AMR). AGVs are designed to follow predetermined paths whereas AMR can move freely throughout a facility. The latter are equipped with a range of technologies to allow safe collaboration with humans.

The food & beverage sector is another high-level adopter of mobile robots. Within this segment there is a large number of cases and pallets which need to be moved, a task well suited for a robot to complete. It is a sector with very predictable end demand, said Sharma, and there is a growing direct-to-consumer model occurring, all of which lends itself to growing use of mobile robots.

Mobile robot revenue potential is strong in the semiconductor manufacturing sector as well. Trade wars are moving production away from China and Taiwan, he said, and there is a greater emphasis on eliminating as much manual labor as possible in this industry because of the high material costs associated with semiconductors.

READ MORE: Rapid Growth Ahead for Mobile Robot Components Market

Larger Robot Payloads Expanding Use Cases

The payload capabilities of AMR conveyors are increasing, enabling customers to move more material around their facilities. Initial robot designs provided 500 kg carrying capacity and now some are up to 1,500 kg.

Sharma said there are two main factors driving robot manufacturers to increase the carrying capacity of their products – one is that it offsets price declines because they can offer customers more for their money by enabling them to move more material; the other is the fact they can be used across more workflows because they are getting bigger and more capable.

The ability to now use a mobile robot in various areas of a facility is helping drive their large-scale adoption.

Automated Fork Trucks Present a Major Opportunity

Sharma said automated fork trucks is a major opportunity area for the mobile robot industry. Through 2027, market penetration for these types of robots is projected to be less than 2% based on current trends.

As with other segments of the industry, the need to lower labor costs as well as the lack of skilled labor will drive growth of the market which is projected to be worth $3.5 billion over the next 3 years. The need for increased safety in facilities and accuracy, and the ever increasing need to move more material will help drive the market as well.

Fork trucks are used to move a range of materials around facilities, especially large, heavy items and so further uptake of automated options could greatly benefit the productivity of various operations.

Although not every fork truck is going to be replaced by an automated version, said Sharma, in those situations where these vehicles are highly utilized it may make sense to do so.

Price is, and is not, a Factor for Buyers

A survey of about 300 mobile robot customers around the world conducted by Interact Analysis found that nearly half of those companies are about to automate or extend automation at their operations. And half of them are intending to use mobile robots to some extent, said Sharma.

Factors influencing the decision to adopt mobile robots include:

- reducing operating costs (35%)

- increasing productivity (29%)

- improving reliability and accuracy in operations (28%) and

- difficulty finding and retaining labor (8%).

He noted that of those survey respondents who are not planning to use mobile robots, cost was the biggest concern. While reducing operating costs is the largest motivator for implementing automation solutions, three quarters of survey respondents said the lack of available budget was preventing faster adoption of automation in their companies.

And yet, when asked about their top criteria for selecting a robot vendor, Sharma said those offering the lowest price was one of the least important factors. Also lower on the list of criteria was a proven return on investment for a robotic solution, despite buyers indicating they expect a short ROI of 1.5-3 years.

Sharma said the survey results were surprising regarding the dichotomy between what buyers said was holding them from purchasing mobile robots and their top criteria for selecting a solution. Higher on the list of criteria were the track record of the robot vendor as well as their integration expertise and support services. Stability of the vendor was also high on the priority list.

As the industry matures and volumes increase, he said it will be interesting to see how these dynamics change and if price will become a greater focus for potential buyers.

About the Author

Sara Jensen

Executive Editor, Power & Motion

Sara Jensen is executive editor of Power & Motion, directing expanded coverage into the modern fluid power space, as well as mechatronic and smart technologies. She has over 15 years of publishing experience. Prior to Power & Motion she spent 11 years with a trade publication for engineers of heavy-duty equipment, the last 3 of which were as the editor and brand lead. Over the course of her time in the B2B industry, Sara has gained an extensive knowledge of various heavy-duty equipment industries — including construction, agriculture, mining and on-road trucks —along with the systems and market trends which impact them such as fluid power and electronic motion control technologies.

You can follow Sara and Power & Motion via the following social media handles:

X (formerly Twitter): @TechnlgyEditor and @PowerMotionTech

LinkedIn: @SaraJensen and @Power&Motion

Facebook: @PowerMotionTech

Leaders relevant to this article: