Manufacturing Industry Projected to Grow 15% by 2028, Despite Slower Growth in 2024

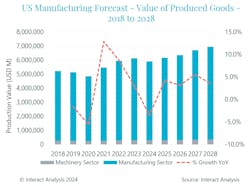

Manufacturing has grown significantly over the last 15 years, doubling in value to $44.8 trillion from 2007-2023 according to market intelligence firm Interact Analysis. The firm is projecting the manufacturing industry to grow 15% through 2028.

Growth has slowed since the peaks reached in 2021 after the COVID-19 crisis, said Blake Griffin, Research Manager, USA of Interact Analysis, during a presentation on the U.S. manufacturing economy at Automate 2024. Both 2022 and 2023 were slower growth periods, and 2024 is anticipated to be a down cycle. But higher growth trends are anticipated starting in 2025.

“It is not super optimistic right now, based on conversations that we have had, but it’s also not the bottom is falling out of manufacturing,” said Griffin. “We’re expecting a flat year globally and growth to return in 2025.”

Industry Sentiments Reflect Lower New Order and Production Figures

The global economic uncertainty which began in the last half of 2023, paired with shrinking backlogs after high levels of demand in 2021-22, was represented in manufacturing production which slowed in the second half of the year. Griffin noted annual figures are not yet available, but production likely remained in positive territory at the end of 2023 despite the declines in growth.

Into 2024, growth is expected to taper off further for the manufacturing sector which he said is demonstrated by the sentiment survey Interact Analysis issued to members of the Association for Advancing Automation (A3) – the trade association which produces the Automate event and represents organizations involved in robotics, artificial intelligence, machine vision, motion control and other automation related technologies.

Members indicated a slight decline in new orders during the last half of 2023, but sentiment is starting to trend into more positive territory with some members indicating slight increases in new orders as 2023 came to an end and 2024 began. Griffin said 20% of respondents are still citing new orders as the greatest issue they’re facing right now, so there is still a lack of demand as many said their customers are not spending due to continued economic uncertainty.

While new orders slowed in the later part of 2023, production was still positive during this time which Griffin said was likely due to backlogs still being quite strong. Production began to slow toward the end of 2023, indicating backlogs are starting to dry up. This will be a factor which plays into the flat growth trends anticipated in 2024.

READ MORE: 2024 Recession Presents Fluid Power Industry Opportunities for Investment

Inflation and Interest Rates Determining Factors for Manufacturing in 2024 and 2025

Economic uncertainty is likely to continue as inflation remains above the U.S. Federal Reserve’s goal of 2%. Griffin said communication from Federal Reserve meetings is that there is still a long way to go to get inflation sustainably down to 2% and so interest rates will remain at higher levels.

There was a period during the last part of 2023 during which it was thought rates would come down as inflation got closer to that 2% target, but the Federal Reserve has since said there is not enough confidence in the data that inflation is yet under control. “They don't want to lower rates too quickly because inflation will surge again, and they don't want to raise rates anymore because they're afraid it's going to put stress on the economy,” explained Griffin. He noted a more recent Federal Reserve meeting indicated more favorable data that inflation may be under control more than previously thought.

“And the important thing is that wage growth has actually slowed down a little bit…it is an indication that the inflationary pressures are starting to ease,” he said. The sentiment survey of A3 members has indicated prices started declining from the highs of 2022 as well over the last few quarters with Q4 2023 being the first during which no respondents indicated a significant increase in prices.

Despite this, Griffin said prices are still somewhat increasing which indicates inflation remains an issue but there are signs it could be easing. “Hopefully, it will start to ease over the next 6 months or so,” he said because he believes how the manufacturing sector performs in the coming months will greatly depend upon what happens with inflation and interest rates.

He shared thoughts from the April 2024 Federal Reserve meeting which showed there was still uncertainty among participants about the persistence of high inflation. However, the majority of participants at that meeting felt moving to a less restrictive policy at some point in 2024 would be feasible assuming the economy evolves broadly as expected.

Read More Market Trends Data

For even more economic and market trends information for the fluid power and electric motion control industries, visit our State of the Industry page. There you'll find video interviews, articles and more overviewing current and future market information as well as insights on how these trends could impact hydraulic, pneumatic and electric component designs.

“They're saying, essentially, that they're not confident to lower rates but if they got better data, they would be comfortable lowering rates,” explained Griffin. “I think the general consensus now is that they're expecting the Fed to lower rates at the end of 2024, potentially into 2025 but hopefully it's not that long.”

When the Federal Reserve does decide to lower interest rates, he said it is not likely to be the essentially 0% rate economy many have been used to in recent years which was a stimulatory rate introduced after 2007. “I think the Fed is going to hold rates between 3 and 4%.”

Once interest rate cuts are enacted, Griffin said Interact Analysis expects they will stimulate growth for the manufacturing economy in 2025 and beyond. The firm is projecting the U.S. manufacturing industry to decline around 3% in 2024. But starting in 2025 it will enter an up-cycle trend through 2028 with an average growth rate between 3 and 5% anticipated.

About the Author

Sara Jensen

Executive Editor, Power & Motion

Sara Jensen is executive editor of Power & Motion, directing expanded coverage into the modern fluid power space, as well as mechatronic and smart technologies. She has over 15 years of publishing experience. Prior to Power & Motion she spent 11 years with a trade publication for engineers of heavy-duty equipment, the last 3 of which were as the editor and brand lead. Over the course of her time in the B2B industry, Sara has gained an extensive knowledge of various heavy-duty equipment industries — including construction, agriculture, mining and on-road trucks —along with the systems and market trends which impact them such as fluid power and electronic motion control technologies.

You can follow Sara and Power & Motion via the following social media handles:

X (formerly Twitter): @TechnlgyEditor and @PowerMotionTech

LinkedIn: @SaraJensen and @Power&Motion

Facebook: @PowerMotionTech

Leaders relevant to this article: