How Automation is Impacting Hydraulic and Pneumatic Designs

What you’ll learn:

- How the design of hydraulics and pneumatics are evolving to meet automation requirements.

- The challenges and opportunities that exist for fluid power in automation applications.

- Why fluid power systems will remain important even as automation brings new technologies to the market.

Use of automation continues to grow in many of the mobile and industrial machinery applications served by the fluid power industry. As such, developments are increasing for hydraulic and pneumatic technologies capable of meeting the needs of automated systems and machines.

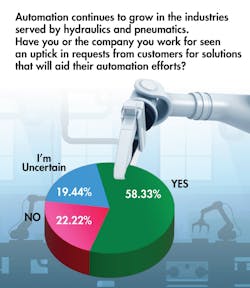

Power & Motion recently conducted a survey of our audience to gauge the impact automation is having on the fluid power industry. Of those who responded, 58% indicated they have seen an uptick in requests from customers for solutions that will aid their automation efforts.

While automation is not new, technological developments in recent years have made it a more viable option for many, particularly in the mobile machinery sector. Ben Holter, Product Director at Husco International, explained that automation has been omnipresent for the last 15 years but somewhat held up by OEMs realizing they need a number of other technologies first such as GNSS (Global Navigation Satellite System) and cloud connectivity.

“Hydraulics have been ready for decades for automation, but we've really been waiting for this convergence of technology to make it possible for our customers to take advantage of it,” he said. Requests for automation have not increased but instead the ability to actually automate systems and machines. “We've seen the upticks happening now that we're finally off the starting line and really into the race, because everything else has become capable.”

How Automation is Influencing the Design of Hydraulics and Pneumatics

Daniella Gonzalez, Product Market Manager Pneumatic and Electro-Pneumatic Valves and Valve Terminals at Festo Corp., agreed that technological innovations are helping drive automation uptake. She said Festo’s customers are looking to improve their automation efforts and today over 80% of them are using automation

Increased demand for automation solutions in the mobile and industrial machinery markets is therefore influencing technological developments for the hydraulics and pneumatics utilized in these machines.

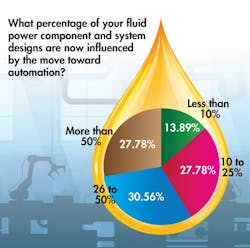

Respondents to Power & Motion’s survey indicated automation is having a strong influence on their fluid power designs. Just 13.8% of respondents said less than 10% of their designs are impacted by automation, and almost 60% indicated that over 25% or more of their designs are influenced by this trend.

“Customers are turning to automation to improve safety, reduce errors, and make operator tasks more manageable,” said Adam Khaw, Head of Autonomy at Danfoss Power Solutions.

As such, Danfoss is seeing its use steadily increase across the off-highway mobile equipment industry. “Engineers are now designing for machines that need to understand their environment and act with precision,” said Khaw. “That shift changes how we think about every system, from core hydraulics to controllers and software.”

Impacts survey respondents indicated automation is having on their fluid power system designs included:

- electrohydraulic technologies comprising a growing share of the market

- more intelligent systems with integrated software applications

- increased interconnectivity and information reporting

- more consideration given to component placement and guarding

- increased need for precision and repeatability.

The majority of respondents, 97%, anticipate greater integration of fluid power and electric technologies in the coming years due to the continued progression of automation, a trend that is already being seen in many instances.

“Hydraulics are evolving into digitally controlled, intelligent systems,” said Khaw. To achieve this, the company is bringing hardware such as its PVG valves together with advanced control platforms to help create full system solutions.

Gonzalez and Holter noted similar design trends. For Husco, Holter said a solenoid — the digital to hydraulic interface — is added to its valves to create an electrohydraulic component which interacts with a controller to provide the desired operation.

Rather than having a mechanical link between the joystick in the operator cab and the valve, logic is built into the controller which provides an output signal for the valve, he explained. This enables more conditions-based control which can help improve overall performance. “When I just have one lever [joystick]…I can only do so much. It's cost effective, it works. But by adding automation now, you can start to add more knowledge of the system, add more understanding to be able to do what I call conditions-based control,” said Holter.

By better understanding machine condition, adjustments to the hydraulics can be made to match the particular operation being undertaken, such as digging, to ensure optimized and efficient performance.

This condition monitoring and control is a principle Festo is applying in its Controlled Pneumatics family of products, said Gonzalez. These pneumatics solutions combine proportional technology, sensors, and control algorithms into a closed-loop control system.

Sensors and controllers built into the closed-loop system perform all necessary performance calculations. Users simply need to enter their desired parameters, and the control system takes care of the rest. This allows for easy setup as well as flexibility to make changes as needed based on current performance conditions or other requirements.

Automation Will Require a Mix of Fluid Power and Other Technologies

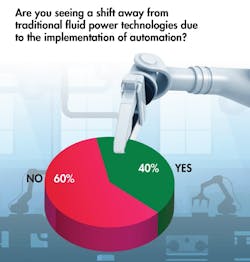

While automation is bringing a number of changes to hydraulics and pneumatics, there is also the question of whether there will be a shift away from fluid power to other technologies.

Most survey respondents, 60%, said they are not seeing a shift away from traditional fluid power technologies because of automation.

Gonzalez, Khaw and Holter agreed there is still a place for hydraulics and pneumatics. But they and our survey respondents noted there are other technologies coming into play as well, particularly electric actuators, creating a wide range of options for design teams to consider.

Download our eBook "The Shift from Fluid Power to Electromechanical Technologies" to learn more about the applications where use of electric actuators and other solutions makes sense as well as insights on how to choose the appropriate motion control technology for your application.

Survey respondents offered the following examples of how they see technology shifts occurring in some applications:

“Linear movements that were once driven by fluid power can now be realized with electrical systems. Hydraulic servo systems are expensive whereas the equivalent electric systems are less expensive and do not require a high degree of maintenance environment.”

“Small and low power fluid power actuators are getting replaced by electro-mechanical linear actuators and electric motors. Servo electric motor operated pumps and sensors on fluid power actuators require less complicated fluid power system design, which reduces dependency on fluid power engineers. Industry is on track to replace fluid power systems on majority of low to mid power applications with electro-mechanical systems in 3-5 years.”

“Automation is driving a shift away from traditional fluid power systems, toward more precise, efficient and digitally integrated technologies. The key technologies replacing fluid power include electromechanical systems, linear actuators, electric drives and motors, robotics and collaborative robots and smart sensors and IoT integration.”

“Brushless DC motor solutions in particular and electrical systems in general are increasing their power density to the point where they are now challenging hydraulic actuation in aircraft systems design.”

Gonzalez said that Festo is seeing increased demand for electric actuators as well as solutions such as its Controlled Pneumatics products which bring together pneumatic and electronic technologies. However, there are also instances where a combination of technologies may be the best fit.

“Some applications have more than one way to solve them, with traditional pneumatics, electric automation, Controlled Pneumatics as well as ‘hybrid’ solutions,” she said. “Festo’s approach is to find the best solution for the application, allowing all our technologies to coexist in customers’ systems.”

Advantages she said that are typically associated with electric actuators include energy efficiency, precision and control as well as compact designs. She pointed out that Festo’s Controlled Pneumatics technologies also offer these benefits in addition to allowing use of many of the same pneumatic components that may already exist in a system.

When determining whether to use electric, fluid power or combination of the two technologies, it is important to take factors such as costs, space claim, existing infrastructure and performance requirements into consideration.

Khaw said Danfoss is seeing electric actuators becoming a more commonly used technology in steering and drive systems “especially where tight control and low maintenance are priorities.”

He also noted they are replacing smaller hydraulic functions, particularly in applications where space, precision or service simplicity is important. “Electric actuation enables smooth, responsive control and integrates easily with autonomy stacks.”

There are some examples in the market of machines which have completely replaced hydraulic systems with electric actuation — the Bobcat T7X all-electric compact track loader being one such example. But in many applications, the value of hydraulics is hard to beat, said Holter because of the power density and robustness they can provide. He noted electric actuation is still too expensive and that maybe in 5-10 years the technology will be more cost effective for the mobile market.

That’s not to say he doesn’t see electric actuation being used in certain instances, and indicated his desire to see parts of machines such as a quick hitch use linear actuators “because it makes the hydraulic system less complex.

“I think there's a lot of places where we could actually add value by taking out hydraulics,” he said. Ancillary parts of a machine that would only require the use of a small actuator offer opportunities to reduce hose routing and other components that can add complexity and weight to a machine.

“We have to realize that electronics are going to take over hydraulics in certain spots, and it's going to make a whole lot of sense and it's going to help move the industry forward,” said Holter.

Where Challenges and Opportunities Exist for Fluid Power in Automation Applications

As fluid power technologies evolve to meet the performance requirements of various automation applications, there are of course challenges to overcome. One of the top challenges noted by survey respondents is the fact there is not enough industry information. And 25% said they are uncertain about what technologies would be beneficial.

Other challenges noted by respondents include customer resistance and the fact some applications would be very expensive to automate as well as the need for better knowledge from suppliers. One respondent also noted that fluid power has matured due to years of feedback from the field, and automation will require similar years of feedback to help it become a more mature technology.

Gonzalez noted there being challenges associated with integration and compatibility with existing systems. “Ensuring that new automation solutions can seamlessly integrate with legacy systems and existing infrastructure can be complex and costly,” she said. But technologies such as Festo’s Controlled Pneumatics can help because it brings new innovations to the table while still using the pneumatics with which customers are familiar.

A challenge Holter noted is the difference between industrial electronics and those used in mobile applications. There are varying voltages, temperatures and other factors to contend with in mobile machinery applications, requiring more ruggedized options and fine tuning of controls.

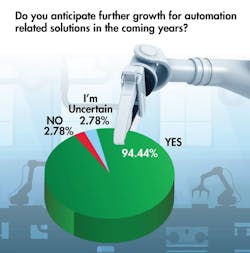

Despite these and other challenges, automation is here to stay, driven in large part by the labor shortages facing many industries and the performance improvements it can bring. The majority of respondents to Power & Motion’s survey, 94%, anticipate further growth for automation-related solutions in the coming years.

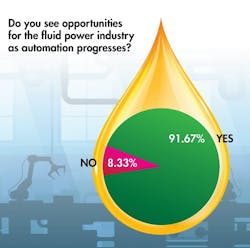

With this growth will come opportunities for the fluid power industry as well. Most survey respondents, 91%, indicated as such, as did Gonzalez, Khaw and Holter.

Some of the opportunities respondents see for hydraulics and pneumatics in automation include:

“The shift to electronics is not wholly possible, as there will remain many applications that require a more robust fluid power solution. It is these applications that will continue to drive fluid power solutions into the automation age.”

“Fluid power in closed, half-open and open systems for certain high pressure/force/performance applications will stay. With the help of sensors, switches and digital control valves, fluid components such as valves, pumps and manifolds can be connected and integrated into inudstrial automation. The value proposition has to be clear (advanced control, improved productivity/efficiency etc.).”

“There will be opportunities in high-force applications in heavy automation, hybrid electro-hydraulic systems, compact pneumatics for lightweight automation, rugged environments and safety critical automation and energy storage and efficiency improvements.”

“Where high power density is required with accurate control, particularly with the advent of fieldbus technology becoming more available in hydraulic components, as they currently are with sensor technology.”

Khaw concluded by saying the opportunities for hydraulics and pneumatics in automation are accelerating. “Fluid power remains the best solution for moving heavy loads with speed and control. As automation progresses, there’s demand for systems that are easier to control, monitor, and adapt,” which Danfoss, Festo, Husco and others in the fluid power industry are working to create.

About the Author

Sara Jensen

Executive Editor, Power & Motion

Sara Jensen is executive editor of Power & Motion, directing expanded coverage into the modern fluid power space, as well as mechatronic and smart technologies. She has over 15 years of publishing experience. Prior to Power & Motion she spent 11 years with a trade publication for engineers of heavy-duty equipment, the last 3 of which were as the editor and brand lead. Over the course of her time in the B2B industry, Sara has gained an extensive knowledge of various heavy-duty equipment industries — including construction, agriculture, mining and on-road trucks —along with the systems and market trends which impact them such as fluid power and electronic motion control technologies.

You can follow Sara and Power & Motion via the following social media handles:

X (formerly Twitter): @TechnlgyEditor and @PowerMotionTech

LinkedIn: @SaraJensen and @Power&Motion

Facebook: @PowerMotionTech