Rockwell Acquisition of Clearpath Robotics Demonstrates Growth of Mobile Robots

Integration of robots of various types continues to grow in manufacturing operations as a means overcoming labor challenges as well as improving overall productivity. Mobile robots in particular are gaining ground to help overcome challenges associated with moving product through manufacturing facilities in an efficient manner.

According to Rockwell Automation — which announced plans to acquire automated mobile robot (AMR) developer Clearpath Robotics Inc. — transporting parts and materials through manufacturing operations are complex, inefficient tasks. Production bottlenecks can occur, hindering a manufacturer's ability to get product out the door as quickly as possible.

However, integration of AMR can help to overcome this challenge by enabling better flow of materials through a facility. Given the benefits many see in use of AMR in manufacturing and other applications, more companies like Rockwell are investing in the technology — either through acquisition or internal development efforts.

"I fully expect to see most major industrial automation companies either acquire or organically develop mobile robot companies in the next few years," said Ash Sharma, senior research director for robotics and warehouse automation at market intelligence firm Interact Analysis.

Acquisition Demonstrates Market Opportunities

Rockwell's acquisition of Clearpath Robotics, including its OTTO Motors Division which develops AMRs as well as fleet management and navigation software, is expected to help expand Rockwell's range of automation solutions aimed at creating more connected and thus productive manufacturing operations.

Bringing Rockwell's knowledge in programmable logic controllers (PLCs) and its fixed robotic arms solutions together with Clearpath's AMR and navigation technology will enable implementation of robotic solutions at various stages of the manufacturing process. The companies are interested in combining data with AMRs to provide manufacturers with full system solutions which provide traceability and increased efficiency.

By combining their expertise, Rockwell and Clearpath can help manufacturers not only improve the efficiency of their operations but also do more with less. Matt Rendall, co-founder and CEO of Clearpath, said in a press release announcing the acquisition that industrial customers feel increased pressure to do so. "Autonomous production logistics is becoming a necessity to meet targets and stay competitive," he said.

Labor is a key part of this, as the manufacturing industry – like so many others – is finding it difficult to find the skilled workforce it requires. In Rockwell's 2023 State of Smart Manufacturing Report, 46% of respondents noted the lack of a skilled workforce as a top concern in maintaining competitiveness. This was up from the previous year's report in which just 35% of respondents noted labor as a top challenge.

Automation solutions like AMR can help to overcome this and keep manufacturers productive while also helping to ease the workload on those working in a manufacturing facility.

"Rockwell and Clearpath together will simplify the difficult and labor-intensive task of moving materials and product through an orchestrated and safe system to optimize operations throughout the entire manufacturing facility," said Blake Moret, Chairman and CEO, Rockwell Automation, in a press release announcing the acquisition. "The combination of autonomous robots and PLC-based line control has long been a dream of plant managers in industries as diverse as automotive and consumer packaged goods. With Clearpath, Rockwell is uniquely positioned to make that dream a reality across virtually all discrete and hybrid verticals, optimizing planning, operations, and the workforce."

Interact Analysis' Sharma views the acquisition of Clearpath as a beneficial one for the AMR market as it demonstrates the growing interest in this technology beyond use in warehouses where it has been more commonly utilized to date. "This acquisition is a further sign that AMRs have a big future as part of the industrial automation toolkit," he said.

Continued Growth Ahead for AMR

Use of AMR as well as automated guided vehicles (AGV) in manufacturing applications are projected to grow in the coming years. In its 2023 State of Smart Manufacturing Report, Rockwell found mobile robots such as AMR and AGV were one of the top investment areas for manufacturers, with 47% of respondents indicating they are investing or plan to invest in these solutions due to the benefits they can provide.

Research from Interact Analysis also indicates the manufacturing industry will be a large driver for growth of mobile robots in the coming years. A growth rate of about 30% is anticipated through 2027 with AMR accounting for the largest share of the market due to the greater range of possible applications in which they can be used.

Unlike AGV, AMR are able to move about freely and be used in collaboration with humans for various tasks. AGVs have to follow a predetermined path which can limit how and where they are used in a facility.

READ MORE: Autonomous Mobile Robots on an Upward Trajectory

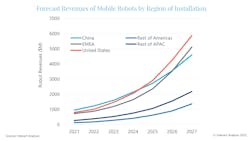

Interact Analysis is forecasting China to be the dominant region of growth for the AMR market due to its large investments in automation technologies like robotics. The Americas and EMEA (Europe and the Middle East) will be strong growth regions as well. The U.S. alone is expected to reach a value of $6 billion in 2027 as reshoring efforts continue and advanced technologies are integrated into the new manufacturing facilities being built in the region.

Greater implementation of mobile robots like AMR will benefit those deploying them as well as the manufacturers, like Rockwell and Clearpath, and component suppliers serving the market. Interact Analysis is projecting the mobile robot components market to grow 44.8% over the next 5 years and notes the manufacturing industry's increased use of mobile robots as a contributing factor.

As AMR continues to prove itself in applications beyond warehouses such as manufacturing and large, well-known companies like Rockwell invest in the technology, more credibility will be given to these solutions which will aid their future growth.

"If AMR deployment takes off on factory floors in a big way, as I believe it will, then we will see major growth for AMRs in this area," concluded Sharma.

About the Author

Sara Jensen

Executive Editor, Power & Motion

Sara Jensen is executive editor of Power & Motion, directing expanded coverage into the modern fluid power space, as well as mechatronic and smart technologies. She has over 15 years of publishing experience. Prior to Power & Motion she spent 11 years with a trade publication for engineers of heavy-duty equipment, the last 3 of which were as the editor and brand lead. Over the course of her time in the B2B industry, Sara has gained an extensive knowledge of various heavy-duty equipment industries — including construction, agriculture, mining and on-road trucks —along with the systems and market trends which impact them such as fluid power and electronic motion control technologies.

You can follow Sara and Power & Motion via the following social media handles:

X (formerly Twitter): @TechnlgyEditor and @PowerMotionTech

LinkedIn: @SaraJensen and @Power&Motion

Facebook: @PowerMotionTech

Leaders relevant to this article: