Packaging Machinery a Bright Spot for Manufacturing Sector

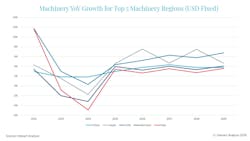

Global economic conditions have burdened many industries in 2024, including the manufacturing sector. According to market intelligence firm Interact Analysis, the machinery segment of this industry has been hit particularly hard.

High interest rates and inventory levels have contributed to lower demand for machinery as well as the components used within them.

The latest quarterly Manufacturing Industry Output (MIO) Tracker from Interact Analysis shows there are some sectors better weathering the current global economic challenges though. Packaging machinery is one of them and is forecast to grow 0.5% globally in 2024.

The Current State of the Packaging Machinery Market

Machinery for packaging materials and goods are utilized in a wide range of industries from pharmaceuticals to food and beverage to cosmetics, just to name a few. Widespread use of packaging machinery in a range of applications will aid the sector’s resiliency in 2024.

Read More Market Trends Data

For even more economic and market trends information for the fluid power industry, visit our State of the Industry page. There you'll find video interviews, articles and more overviewing current and future market information as well as insights on how these trends could impact hydraulic and pneumatic system designs.

Investments in the manufacturing sector are likely to benefit packaging machinery this year and into 2025 and beyond as these machines are important to the final stages of the production process. Results will vary by region though.

Interact Analysis said China is the world’s largest machinery producer but is currently dealing with an overcapacity situation due in part to weak domestic and export demand. Shifting investments from other sectors to manufacturing also contributed to this and is causing downward pressure on prices globally, said the market intelligence firm. This is making it difficult for other regions to compete in the manufacturing machinery market.

Oversupply is also hindering innovation in China because manufacturers are focused on unloading inventory instead of developing new technologies which could negatively impact growth for the region.

Technology adoption could be a factor which impacts recovery for the U.S. manufacturing machinery market in 2025 as well. Domestic machinery production still lags behind many other global markets, noted Interact Analysis. In addition, it takes time for manufacturing facilities to come online, slowing the uptake of new machines to an extent.

However, investments are being made in the manufacturing sector — such as the CHIPS and Science Act and Infrastructure Investment and Jobs Act — which should help to increase demand for machinery of various types, including those for packaging as well as technologically advanced options. As such, recovery is anticipated for the U.S. manufacturing machinery market starting in 2025 and continuing through the rest of the decade. (see Fig. 1 below)

Germany, also one of the top global regions for machinery production, is currently facing significant headwinds. Interact Analysis is forecasting a 2.5% decline in 2024 for Germany’s machinery sector. Packaging machinery will be impacted the firm said due to weakened domestic demand and competition from Asian manufacturers.

The country’s focus on producing high-quality, precision packaging machinery for use in industries such as pharmaceuticals and food processing should help to alleviate some of these challenges though said Interact Analysis. This should help in the long-term as well because Germany has a strong reputation for engineering excellence. The market intelligence firm noted it will be important for the region to adapt to rising demand for automated and sustainable packaging solutions to ensure its long-term competitive advantage.

Packaging Machinery to Benefit from Drive Toward Automation

Interact Analysis said sustained investment in automation within the packaging machinery sector will be a benefit going forward. It noted that companies in China, Italy, and the U.S. are embracing automation to improve efficiency and cut costs; packaging machinery has become a critical area of focus for these investments.

Automation also plays into sustainability by improving productivity and efficiency, leading to less energy used and thus emissions produced. As sustainability has become a larger focus for many, the market intelligence firm sees companies which leverage automation to address sustainability issues faring the best in 2025 and beyond.

This focus on sustainability and the more efficient, automated technologies being developed as a result could play a part in the motion control components utilized in packaging machinery going forward. Data shared by the National Fluid Power Association (NFPA) in a 2023 report showed packaging machinery is one of the top 20 customer markets for the fluid power industry.

Hydraulic and pneumatic technologies are still used in many packaging machinery applications. But like other machinery segments, there is also a move toward electromechanical alternatives where feasible. Electric actuators, for instance, are considered by many to be more efficient while also providing improved precision and reliability, both of which are important in automation.

Learn More about the Transition from Fluid Power to Electromechanical Technologies

To ensure continued relevancy of hydraulics and pneumatics in industrial applications like packaging machinery, NFPA’s next Technology Roadmap will focus on these applications. The roadmap is a document which highlights development areas the industry should consider prioritizing its efforts to meet customer needs. It is currently seeking input from the fluid power industry and industrial customer markets to help create this document.

Overall, Interact Analysis said the packing machinery sector is proving to be a resilient outlier of the manufacturing segment and is expected to remain on its growth trajectory in the coming years. Its more positive outlook will help bring the broader machinery market out of its slump.

There are of course some uncertainties such as which regions will fare well, and which will continue to struggle. The firm noted this is exemplified by Germany’s current situation contrasted with the strong growth taking place in smaller Asian countries such as South Korea. Competitive pressures in Europe and increasing demand for sustainable packaging machinery solutions will contribute to future market conditions as well.

In general, though, Interact Analysis said there is optimism that 2025 will be a turning point for the packaging and broader manufacturing machinery market. Continued investments in new technologies and automation will play important roles in the market’s recovery.

About the Author

Sara Jensen

Executive Editor, Power & Motion

Sara Jensen is executive editor of Power & Motion, directing expanded coverage into the modern fluid power space, as well as mechatronic and smart technologies. She has over 15 years of publishing experience. Prior to Power & Motion she spent 11 years with a trade publication for engineers of heavy-duty equipment, the last 3 of which were as the editor and brand lead. Over the course of her time in the B2B industry, Sara has gained an extensive knowledge of various heavy-duty equipment industries — including construction, agriculture, mining and on-road trucks —along with the systems and market trends which impact them such as fluid power and electronic motion control technologies.

You can follow Sara and Power & Motion via the following social media handles:

X (formerly Twitter): @TechnlgyEditor and @PowerMotionTech

LinkedIn: @SaraJensen and @Power&Motion

Facebook: @PowerMotionTech

Leaders relevant to this article: